2025-06-04

finance

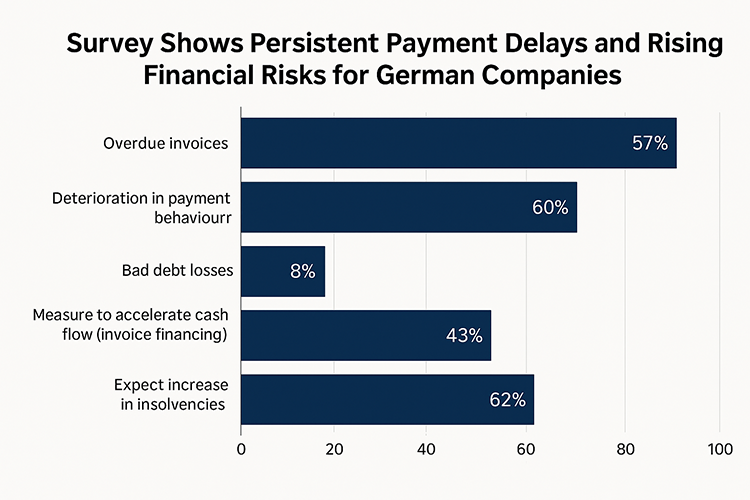

German companies continue to face challenges in managing financial risks in the current economic climate, according to the latest Payment Barometer survey conducted by international credit insurer Atradius. The survey highlights ongoing difficulties with late payments, an increase in bad debt, and pressure on liquidity in the business-to-business (B2B) sector. According to the survey, 60 percent of German companies report a decline in their customers’ payment behaviour. On average, 57 percent of B2B transactions are impacted by overdue invoices. The proportion of uncollectible receivables remains at an average of eight percent, with the mechanical engineering sector particularly affected by liquidity pressures due to increased bad debt losses. Despite these conditions, more than half of the companies surveyed have largely maintained their existing payment terms to customers in an effort to sustain business relationships. In the mechanical engineering sector, 80 percent of companies have either maintained or extended payment terms. Overall, 47 percent of B2B sales are made on credit, with average payment terms of 60 days. Many companies are adjusting their financing strategies to address liquidity pressures. Approximately 43 percent are turning to invoice financing to support cash flow by using outstanding receivables as collateral. Some companies are also delaying payments to their own suppliers, although this carries the risk of creating liquidity bottlenecks across supply chains. Atradius notes a trend toward combined strategies for managing payment risks. About 46 percent of companies, particularly in the automotive industry, are combining credit insurance with internal risk management measures. Firms in the construction and mechanical engineering sectors are placing greater reliance on external credit protection. The survey also points to industry-specific challenges. The construction sector maintains a stable 49 percent share of B2B sales on credit, but around two-thirds of invoices are paid late. Bad debt losses in this sector have declined to five percent, indicating improvements in debt collection processes. Nevertheless, working capital remains tied up in inventories, increasing operational costs. In the mechanical engineering sector, 52 percent of sales are made on credit, with more than half of invoices overdue. The proportion of uncollectible receivables is about 10 percent, and inventories continue to bind significant capital. Atradius observes that payment delays are creating additional liquidity challenges and raising concerns about the sustainability of supplier credit policies. The automotive sector has seen a decline in the proportion of B2B credit sales, falling by 20 percent compared to 2024, while late payments have increased by 12 percent. However, bad debt losses have decreased, suggesting improved receivables management and tighter control over working capital. Looking ahead, 62 percent of companies surveyed expect a rise in customer insolvencies over the next twelve months, with the figure reaching 66 percent among construction firms. At the same time, 30 percent anticipate further extensions in payment terms, while an equal proportion expect some suppliers to shorten terms, which could add further strain on liquidity. Atradius concludes that companies are operating in a volatile environment where financial risks are becoming harder to manage without comprehensive strategies. Combining internal risk controls with external protection, such as credit insurance, is becoming increasingly important. Risk management approaches vary by industry, with construction companies showing greater reliance on external solutions, and mechanical engineering firms preferring a combination of internal and external measures.