2025-06-09

indicators

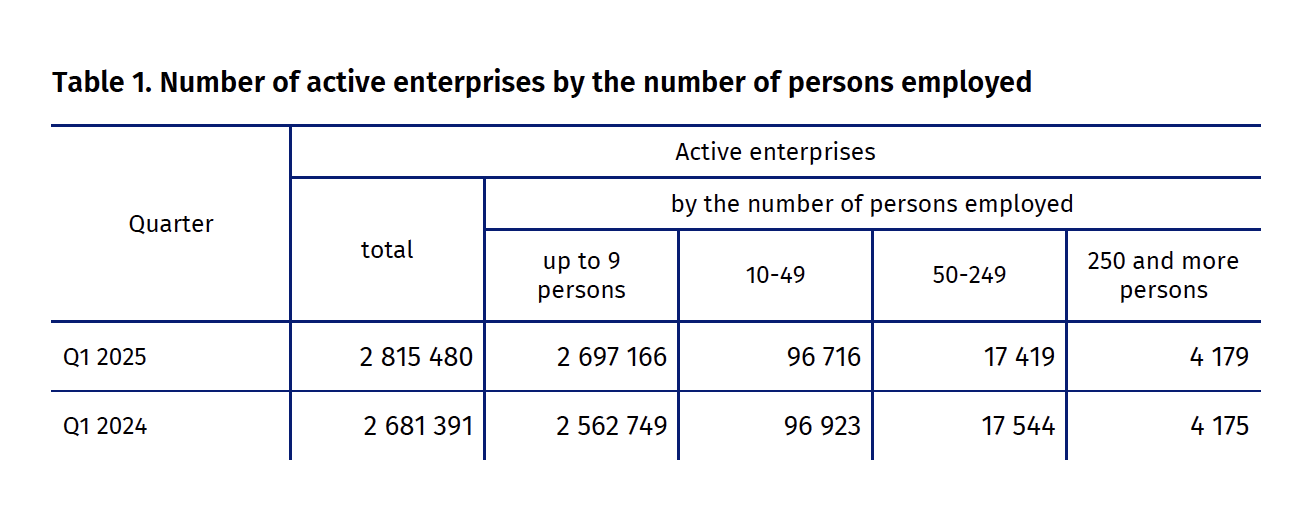

Poland recorded a total of 2,815,480 active enterprises in the first quarter of 2025, marking a 5.0% increase compared to the same period in 2024, according to data published by Statistics Poland. This growth highlights continued resilience in the country’s business sector, particularly among smaller enterprises. Micro-enterprises, defined as those employing up to nine individuals, constituted 95.8% of all active enterprises and saw their numbers rise by 5.3% year-on-year. In contrast, small enterprises (10–49 employees) and medium-sized enterprises (50–249 employees) experienced modest declines of 0.2% and 0.7%, respectively. Large enterprises (those with 250 or more employees) saw a slight increase, with four additional entities compared to the previous year. Sectoral data show that the largest proportion of active enterprises operated in trade and repair of motor vehicles (17.7%), followed by construction (15.1%) and professional, scientific, and technical activities (13.7%). Mining and quarrying, along with energy generation and supply, continued to account for the smallest shares of active enterprises, at 0.1% and 0.3%, respectively. The most significant growth in enterprise numbers was observed in administrative and support activities (11.5%), education (9.0%), and arts, entertainment, and recreation (8.5%) sectors. Geographically, the Mazowieckie voivodeship remained the dominant region, hosting 19.9% of all active enterprises, followed by Wielkopolskie (10.3%), Śląskie (10.3%), and Małopolskie (10.0%). The Opolskie voivodeship recorded the fewest enterprises at 1.9% of the national total. The Mazowieckie region also led among large enterprises, accounting for 26.8% of the total, ahead of Śląskie (12.1%) and Wielkopolskie (11.1%). At the local level, the powiats with the highest number of enterprises outside cities with powiat status were Poznański (46,482 enterprises), Piaseczyński (26,392), and Krakowski (25,017). Conversely, the powiats with the fewest enterprises included Kazimierski, Bieszczadzki, Gołdapski, Węgorzewski, and Sejneński, each hosting fewer than 1,300 active businesses. Compared to the first quarter of 2024, 90 powiats saw growth rates above the national average of 5.0%, with the strongest increases observed in Legionowski, Skierniewicki, Pucki, Gdański, and Piaseczyński powiats, where growth exceeded 7.0%. Notably, no powiat reported a decline in the number of active enterprises. These findings indicate a stable expansion of Poland’s enterprise landscape, driven primarily by the micro-enterprise sector, with continued concentration in key economic regions and an increasing presence in support services and education sectors. Source: Statistics Poland