2025-06-10

finance

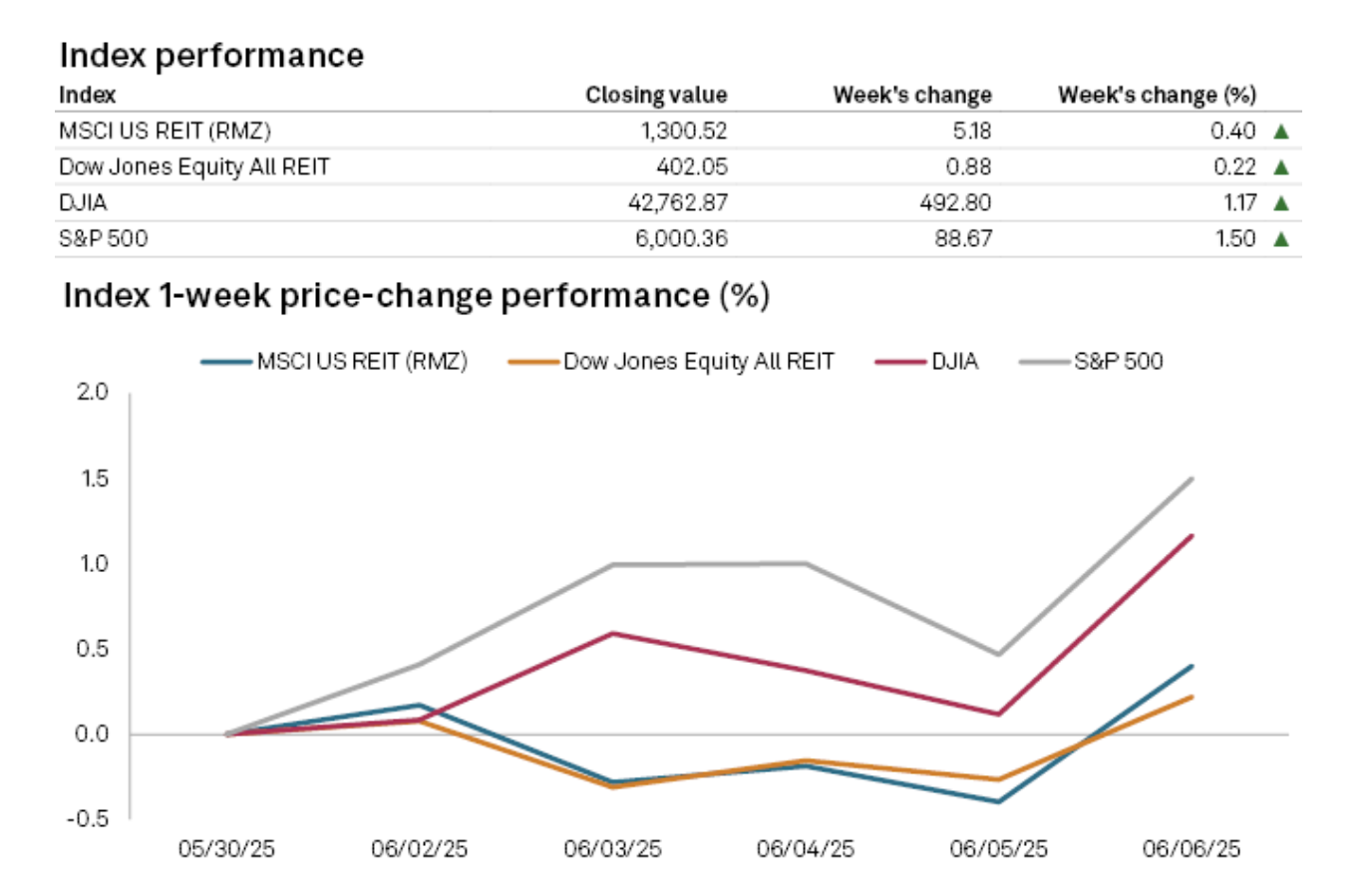

The U.S. office real estate investment trust (REIT) sector recorded the strongest performance among real estate segments during the first week of June. The Dow Jones U.S. Office REIT Index rose by 5.80%, marking the highest weekly gain across all tracked real estate sectors. Industrial REITs also posted gains, increasing by 0.80%, while healthcare REITs saw a marginal uptick of 0.03%. In contrast, apartment REITs declined by 2.01%, and both retail and hotel REITs experienced slight decreases of 0.32% and 0.14%, respectively. Broadly, the U.S. equity REIT market saw modest overall growth. The Dow Jones Equity All REIT Index rose by 0.22%, and the MSCI U.S. REIT Index (RMZ) gained 0.40%. These increases were more subdued compared to broader stock market benchmarks. The S&P 500 climbed 1.50%, while the Dow Jones Industrial Average advanced 1.17% over the same period. Office REITs dominated the list of top-performing real estate stocks with market capitalizations above $200 million. Hudson Pacific Properties Inc. recorded the largest gain, with its share price rising 26.34% during the week. SL Green Realty Corp. and BXP Inc. followed with increases of 13.37% and 10.08%, respectively. Empire State Realty Trust Inc. and Kilroy Realty Corp. also posted strong results, up 9.66% and 8.45%. On the downside, Mid-America Apartment Communities Inc., a multifamily REIT, experienced the largest weekly decline, with its share price falling 4.32%. American Homes 4 Rent and SBA Communications Corp. also saw losses, with declines of 3.09% and 2.68%, respectively. The performance gap between office and residential REITs highlights ongoing sector-specific dynamics, as investor sentiment continues to shift in response to macroeconomic trends and evolving market conditions. Source: S&P Global