2025-07-22

indicators

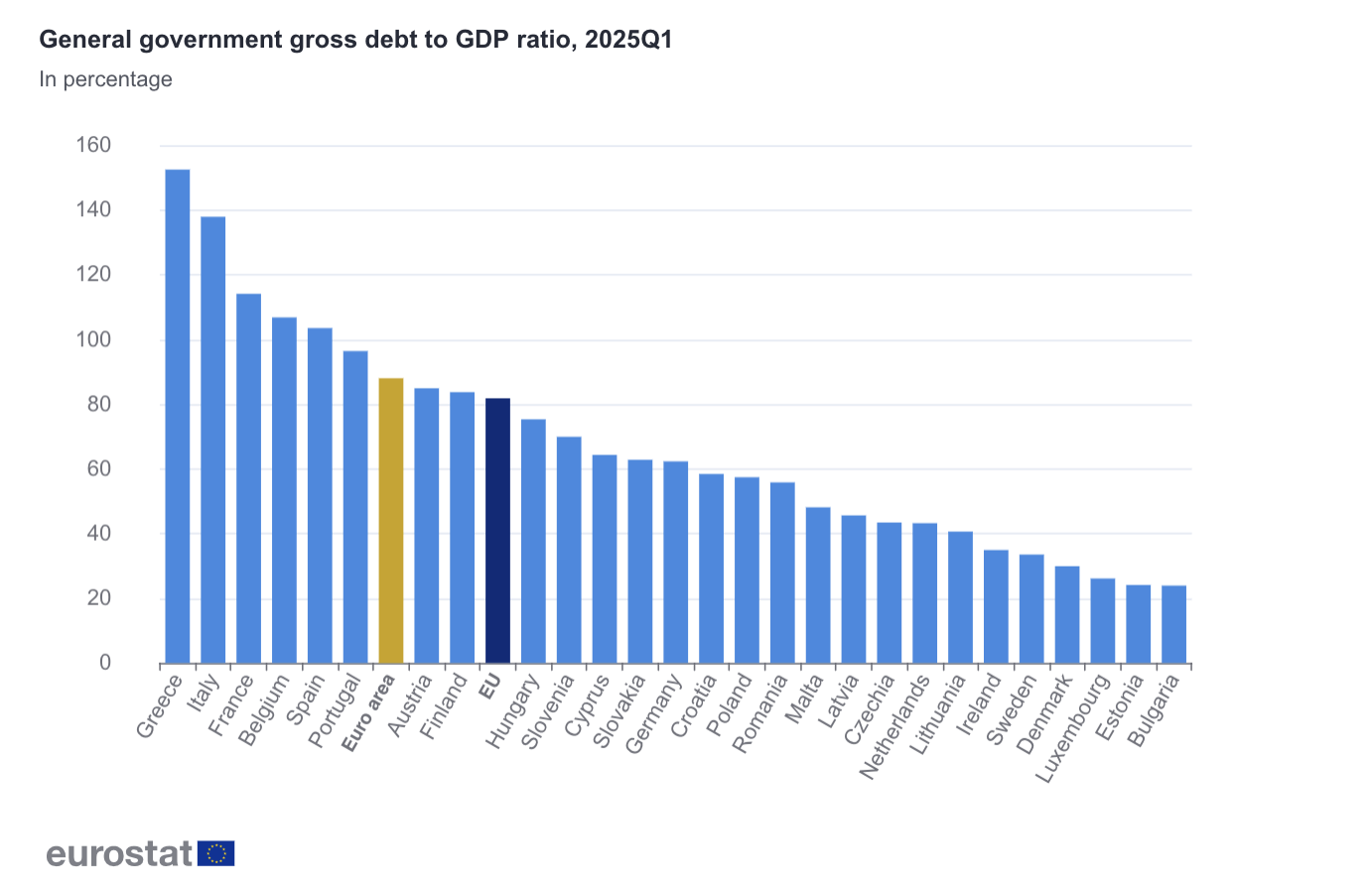

According to Eurostat data for the first quarter of 2025, the euro area’s general government gross debt stood at 88.0% of GDP, marking an increase from 87.4% in the fourth quarter of 2024. In the European Union as a whole, the ratio rose to 81.8%, up from 81.0% in the previous quarter. Compared to the same period last year, the debt-to-GDP ratio increased slightly in both the euro area (from 87.8%) and the EU (from 81.2%). Debt instruments continued to be dominated by debt securities, which accounted for 84.2% of total government debt in the euro area and 83.6% in the EU. Loans comprised 13.3% in the euro area and 13.9% in the EU, while currency and deposits made up the remainder. Intergovernmental lending (IGL), largely related to financial assistance between EU countries, was recorded at 1.4% of GDP in the euro area and 1.2% in the EU. Member State Overview The highest government debt-to-GDP ratios were recorded in: • Greece (152.5%) • Italy (137.9%) • France (114.1%) • Belgium (106.8%) • Spain (103.5%) The lowest ratios were noted in: • Bulgaria (23.9%) • Estonia (24.1%) • Luxembourg (26.1%) • Denmark (29.9%) From Q4 2024 to Q1 2025, debt ratios rose in 16 EU Member States, remained unchanged in Czechia, and declined in 10 countries. The largest quarterly increases were observed in Austria and Slovakia (both +3.5 pp), Slovenia (+2.9 pp), and Italy (+2.5 pp). The biggest decreases were in Ireland (-3.7 pp), Latvia (-1.2 pp), and Greece (-1.1 pp). Year-on-year comparisons revealed a rise in the debt ratio in 13 Member States, with Poland (+6.1 pp), Finland (+5.1 pp), and Austria and Romania (both +4.1 pp) experiencing the most significant increases. Greece (-9.3 pp), Cyprus (-8.2 pp), and Ireland (-6.1 pp) saw the sharpest declines. Poland’s government debt reached PLN 2.12 trillion in Q1 2025, representing 57.4% of GDP. This reflects a 2.2 percentage point increase over the previous quarter and a 6.1 pp rise compared to Q1 2024, the largest annual increase in the EU. The debt figures are based on the Maastricht definition and follow the European System of Accounts (ESA 2010). They include the consolidated gross debt of the general government sector in the form of currency and deposits, debt securities, and loans, valued at nominal face value. All Q1 2025 data are considered provisional and are subject to revision. The next comprehensive review of government debt levels will be included in the Excessive Deficit Procedure notification due in October 2025.