2025-07-24

hospitality

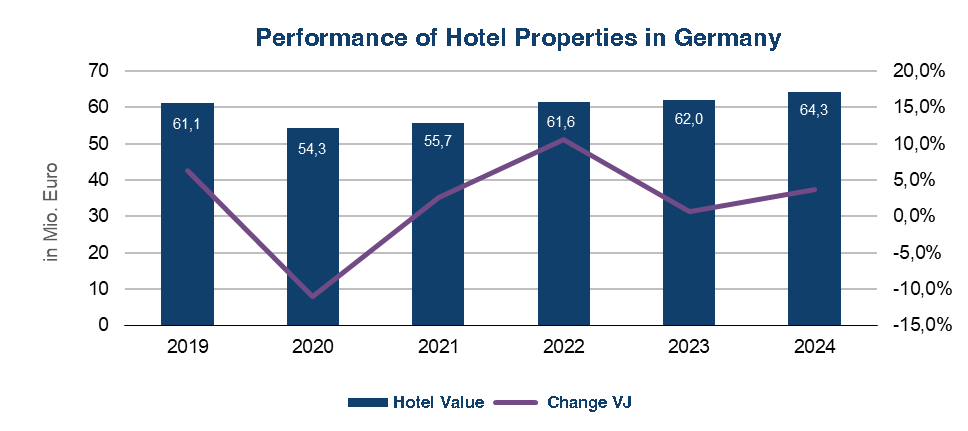

The German hotel investment market showed a notable recovery in the first half of 2025, with transaction volumes exceeding those of the previous four years. Investor activity increased among both domestic and international players, supported by improving hotel performance indicators and steady growth in overnight stays. Despite ongoing global economic and political uncertainties, the sector’s fundamentals contributed to renewed confidence. In 2024, Germany recorded 496 million overnight stays, marking the fourth consecutive year of growth. Rising occupancy rates across the country’s hotel sector were driven by a combination of domestic tourism, major events, trade fairs, and the European Football Championship. However, many hotel operators continued to face financial pressure due to elevated operating costs. Hotel revenue performance improved considerably in 2024, approaching pre-pandemic levels. This recovery was reflected in the overall value of hotel assets. According to an assessment by Union Investment and bulwiengesa, the value of the investment-relevant hotel portfolio (excluding new developments) rose by 1.5 percent. The average value per hotel room increased to €152,000—surpassing the 2019 pre-pandemic figure of €150,800—for the first time. The total market value of hotel properties, including both existing stock and completed developments, reached €64.3 billion at the end of 2024. This represents a 3.7 percent increase from the previous year’s estimate of €62.0 billion. Around 450,000 square metres of new hotel space were delivered in 2024, despite a continued decline in construction activity linked to prior delays in project development due to financing and cost concerns. Much of the new development in 2024 met institutional investment criteria. Approximately 80 percent of newly completed rooms aligned with investor requirements, supported by demand for quality operators and adaptable asset concepts. The 4-star segment, excluding luxury properties, accounted for around 60 percent of completions, partly due to the inclusion of serviced apartments within this category. Room values varied significantly by segment. The average ranged from €136,500 in the budget/economy sector to €284,000 in the upper-upscale and luxury segments. Properties in the upper-upscale category reported particularly strong gains, underpinned by higher occupancy and increased room revenues. Serviced apartments emerged as a significant growth area, accounting for roughly 29 percent of all new room completions. These units, which focus on extended stays and digitalised operations, have demonstrated resilience and consistent occupancy. According to Apartmentservice, the average occupancy for serviced apartments reached 81 percent in 2024, with an average daily rate of €91. Operator groups such as Numa, Stayery, Bob W., and Limehome continued their expansion, emphasising automation and operational flexibility. Conversions played an increasing role in hotel supply in 2024. Around 10 percent of all completed rooms came from change-of-use projects, particularly in urban office-dominated areas. The integration of hotels and serviced apartments into mixed-use developments is being explored as a way to promote neighbourhood diversity. However, the viability of such conversions continues to depend on structural suitability, local demand, and operator interest. Overall, while challenges persist in terms of costs and construction pipeline, the German hotel property market has regained momentum, with growing investor interest and asset values once again exceeding pre-pandemic benchmarks.