2025-07-24

energy

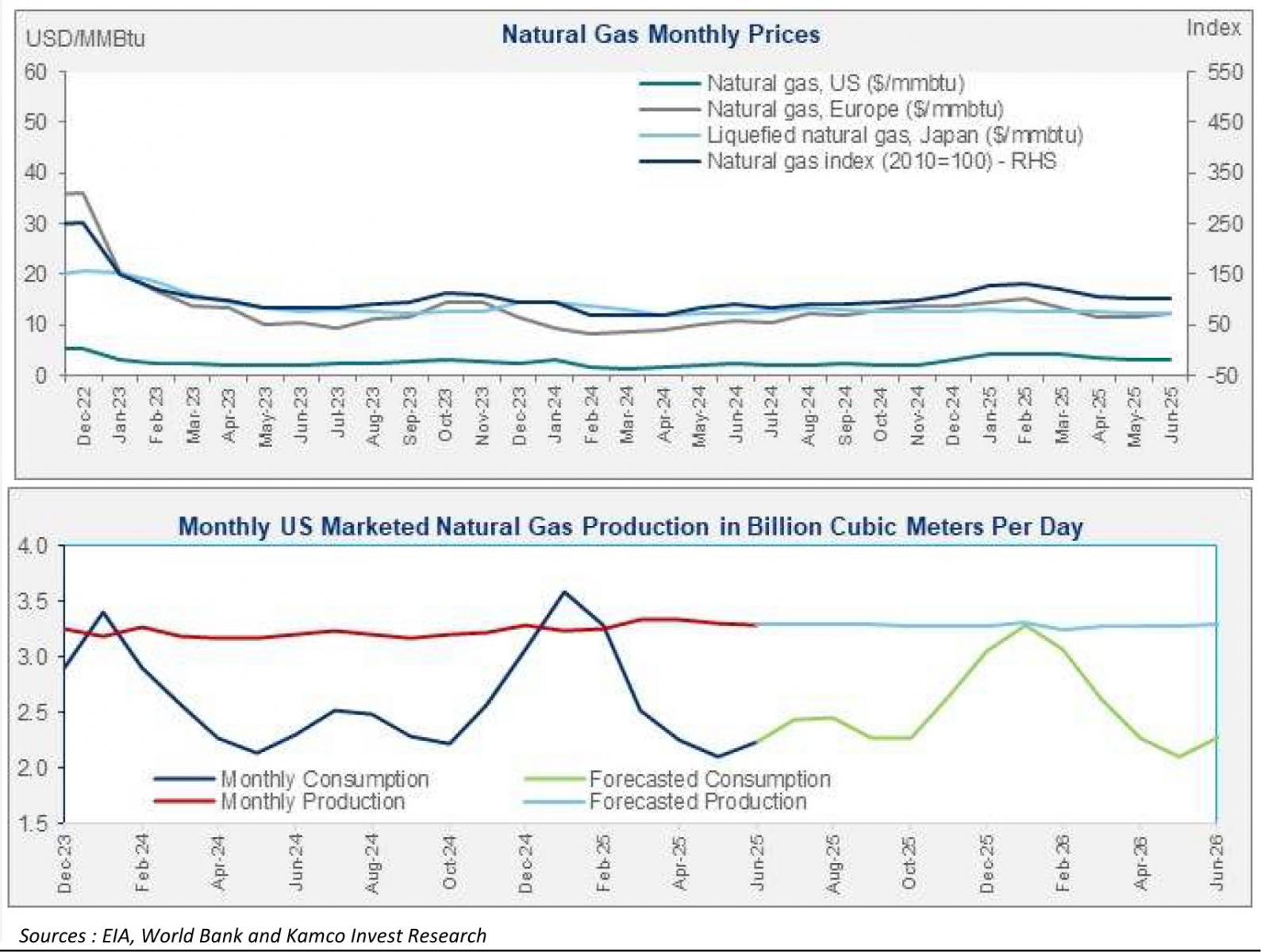

The global natural gas market recorded moderate price increases and stronger demand in the second quarter of 2025, driven by geopolitical tensions, seasonal factors, and rising liquefied natural gas (LNG) imports, according to Kamco Invest’s Q2 2025 market review. In June 2025, U.S. natural gas prices rose by 20.3% year-on-year to USD 3.02/MMBtu, while European prices increased by 13.8% to USD 12.37/MMBtu. Japan’s LNG prices saw a smaller rise of 1.1% to USD 12.26/MMBtu. The Gas Exporting Countries Forum (GECF) reported a 14% year-on-year increase in TTF spot prices, averaging USD 12.3/MMBtu in June. Higher demand in North America and Asia Pacific, coupled with reduced Russian pipeline gas flows to Europe, contributed to these price movements. European LNG imports grew significantly, with a 9.4% annual increase in June alone—the strongest growth rate since November 2022. The European Union (EU), aiming to fill its gas storage to 90% capacity by November, has continued to replace declining domestic production and reduced Norwegian output with LNG purchases. China, on the other hand, reduced LNG imports by relying more heavily on pipeline gas from Russia and Central Asia, as high spot prices weighed on its import strategy. Global natural gas demand is expected to grow by 2% in 2025, supported primarily by Asia and North America. Global production is also projected to rise by 2%, led by the Middle East. In Q2 2025, the EU’s gas consumption rose by 2.5% year-on-year to 57.5 bcm, while U.S. consumption increased 0.9% to 202.5 bcm. China’s consumption rose marginally by 0.1% to 106.6 bcm between March and May. U.S. gas production reached 271.6 bcm in Q2, a 0.6% annual increase. However, the International Energy Agency (IEA) forecasts slower global gas demand growth in 2025, at 1.3%, compared to 2.8% in 2024. Asia Pacific demand is expected to expand by less than 1%, the weakest pace in three years. In the first half of 2025, natural gas consumption in Asia declined by 1.5%, reversing the 5.5% growth recorded in 2024. Japan and South Korea saw reductions of 1.2% and 2.5%, respectively, mainly due to lower power sector demand and increased hydroelectric output in Japan. In contrast, OECD Europe saw a 6.5% increase in gas consumption, with colder weather and lower renewable output boosting demand in the power sector, which accounted for 80% of the increase. Gas-to-power use in the region rose by 20%, while industrial use declined by 2% due to persistent high prices. In North America, gas consumption rose by 2.5% in the first half of 2025, with a 2.8% increase in the U.S. and a 5% rise in Canada. The growth was primarily weather-driven, with colder temperatures leading to higher heating demand. Mexico, however, recorded a 4% decline in consumption due to reduced gas-fired electricity generation. On the supply side, U.S. gas production in the first half of 2025 increased by 2.4% to 542 bcm. Canada’s output rose by 1.5% to 82.5 bcm. In Latin America and the Caribbean, production remained stable at 63.4 bcm. Asia Pacific production reached 293.7 bcm, with China accounting for over 37% of the region’s total. China’s output rose to 109.6 bcm, supported by the expansion of the Shenhai Yihao offshore gas field. In the Middle East, which contributes 18% of global gas production and 25% of LNG supply, output is expected to reach 755 bcm in 2025, up from 736 bcm in 2024. Qatar and the UAE are expected to lead this growth. The UAE recently signed a USD 400 million LNG supply deal with Germany’s SEFE and awarded USD 5 billion in contracts for Phase I of its Rich Gas Development Project, aiming to boost production capacity and LNG export volumes. The outlook for global gas markets in the second half of 2025 remains shaped by storage targets in Europe, geopolitical uncertainty, and varying regional weather conditions. While demand growth is moderating compared to 2024, structural shifts in energy sourcing and infrastructure investment continue to influence market dynamics.