2025-07-24

indicators

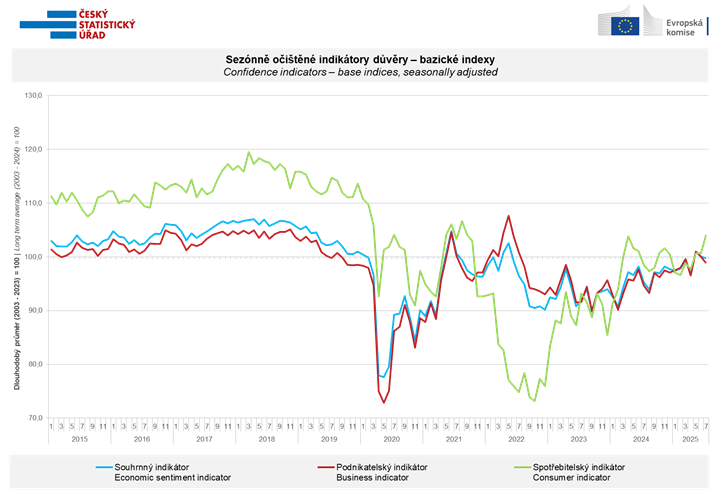

The composite economic sentiment indicator for the Czech Republic declined slightly in July, reflecting diverging trends between businesses and consumers, according to the Czech Statistical Office. The overall confidence indicator fell by 0.4 points month-on-month (m-o-m) to 99.7. Business confidence declined by 1.2 points to 98.8, dropping below the long-term average, while consumer confidence rose by 3.4 points to 104.1—its highest level since November 2021. All indicators remain higher than they were in July 2024. Industry Sector Confidence in the industrial sector fell by 1.0 point to 93.5 m-o-m. While current demand and inventory levels remained stable, expectations for production over the next three months declined. Approximately 45% of respondents cited insufficient demand as a barrier to production, up slightly from the previous quarter. Material shortages were reported by 21% of businesses. Despite these concerns, production capacity utilization increased to 84%, and contract coverage remained steady at 9.3 months. Construction Sector Confidence in the construction sector was unchanged at 121.2. Firms’ views on demand, workforce expectations, and anticipated price changes remained stable. Staff shortages continue to be the main production constraint, noted by 38% of respondents. However, the proportion citing insufficient demand as a limiting factor rose to 29%, from 17% in April. Year-on-year (y-o-y), overall confidence in the construction sector is higher. Trade Sector Business sentiment in trade improved, with the confidence indicator rising by 2.6 points to 97.3 m-o-m. More businesses reported improvements in their recent economic situation and held a slightly more positive outlook for the coming months. Inventory levels declined, while price expectations remained stable. Despite the monthly gain, confidence in this sector remains lower compared to the same time last year. Service Sector In selected service industries, including finance, business confidence declined by 2.1 points to 102.0 m-o-m. While businesses had a slightly more positive outlook on future demand and prices, assessments of current economic conditions fell. Nearly half of respondents reported no production barriers. Around 22% cited other challenges such as regulation, high input costs, or geopolitical concerns. The proportion facing insufficient demand remained unchanged at 16%. Compared to July 2024, sentiment in the services sector has improved. Consumer Confidence Consumer sentiment rose by 3.4 points to 104.1 m-o-m. The number of households expecting a worsening national economic situation declined. Around 26% of respondents reported struggling to make ends meet, with 3% depending on borrowing. Conversely, about 60% said they were able to save regularly. Fewer households indicated reluctance to make major purchases in the coming year. However, concerns about unemployment and inflation increased slightly. Consumer confidence remains higher than a year ago. Source: CZSO