2025-07-26

indicators

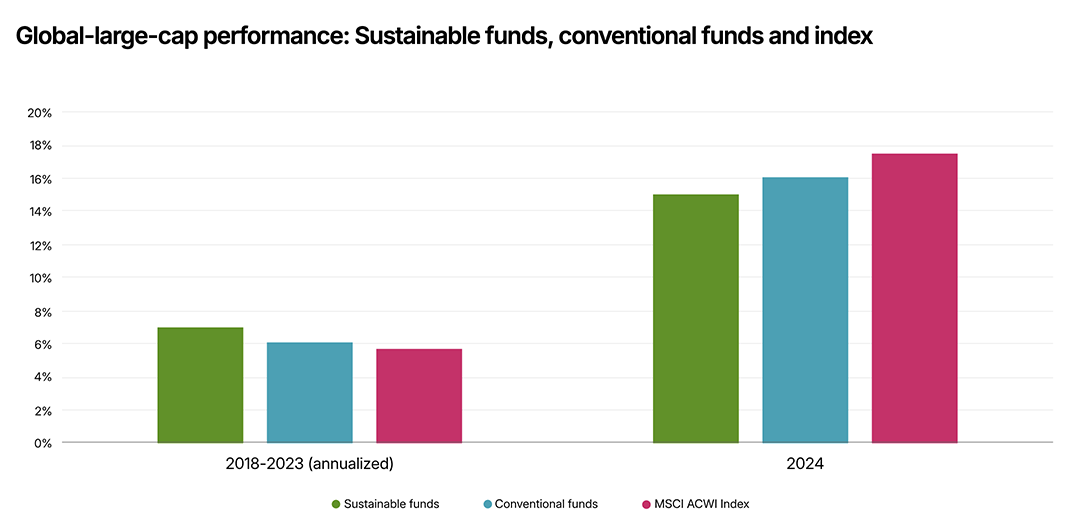

European sustainable investment funds experienced a notable shift in Q1 2025, posting their first-ever quarterly outflows of USD 1.2 billion after a period of consistent growth. Despite the outflows, which represented less than 0.05% of the total USD 2.7 trillion in sustainable assets as of March 31, 2025, investor loyalty remains strong. The shift may reflect a recalibration of strategies and expectations rather than a retreat from sustainable investing. Between 2018 and 2023, sustainable global-equity funds consistently outperformed conventional peers and the broader MSCI ACWI Index. However, in 2024, these funds began to underperform — largely due to their limited exposure to defense companies, which saw strong returns. For example, companies with weapons exposure in the MSCI Europe Index posted an average annual return of 29% in 2024 and came to represent more than 10% of the index by mid-2025. This divergence in performance has prompted some asset managers to revisit exclusionary policies around weapons while seeking to uphold ethical standards. Importantly, investors in sustainable funds appear more committed than those in conventional funds, with less sensitivity to short-term underperformance. Research indicates a weaker correlation between fund flows and three-year returns among sustainable equity and fixed-income funds, suggesting that investors remain focused on sustainability goals, impact, and regulatory alignment over immediate gains. Contrary to concerns, widespread fund renaming in response to EU regulatory changes has not triggered significant outflows. More than 800 Article 8 and Article 9 funds underwent rebranding between May 2024 and June 2025, following new naming guidelines by the European Securities and Markets Authority. However, renamed funds did not experience greater outflows than those that retained their original titles. Only one of the six sustainability funds on the top-outflows list in Q1 2025 had been renamed, pointing to broader market or geopolitical influences as the more likely driver. Further analysis shows that nearly 90% of renamed funds maintained a clear sustainability focus, indicating that fund managers remain committed to responsible investing regardless of branding. Investors also seem to be evaluating funds based on their actual portfolio characteristics rather than just names. In some cases, rebranded funds have attracted a broader base of investors looking for less constrained, more diversified sustainability strategies. The commitment to sustainability is evident not only in dedicated ESG products but also in conventional funds. Among the top 25 European fund houses by assets under management, all but one — Vanguard — integrate financially material sustainability factors in their investment processes. These firms collectively manage over EUR 6.3 trillion in retail funds, showing the depth of sustainable integration across the European asset management industry. While Q1 2025 marked a moment of correction, it may also signal maturation within the ESG space. Investors remain focused on both sustainability values and financial performance, and fund managers are adapting by balancing ethical considerations with long-term value creation. The sector’s resilience, particularly the loyalty of its investor base, suggests that sustainable investing in Europe is not in decline but rather evolving to meet more nuanced expectations. Source: MSCI ESG Research