2025-07-28

indicators

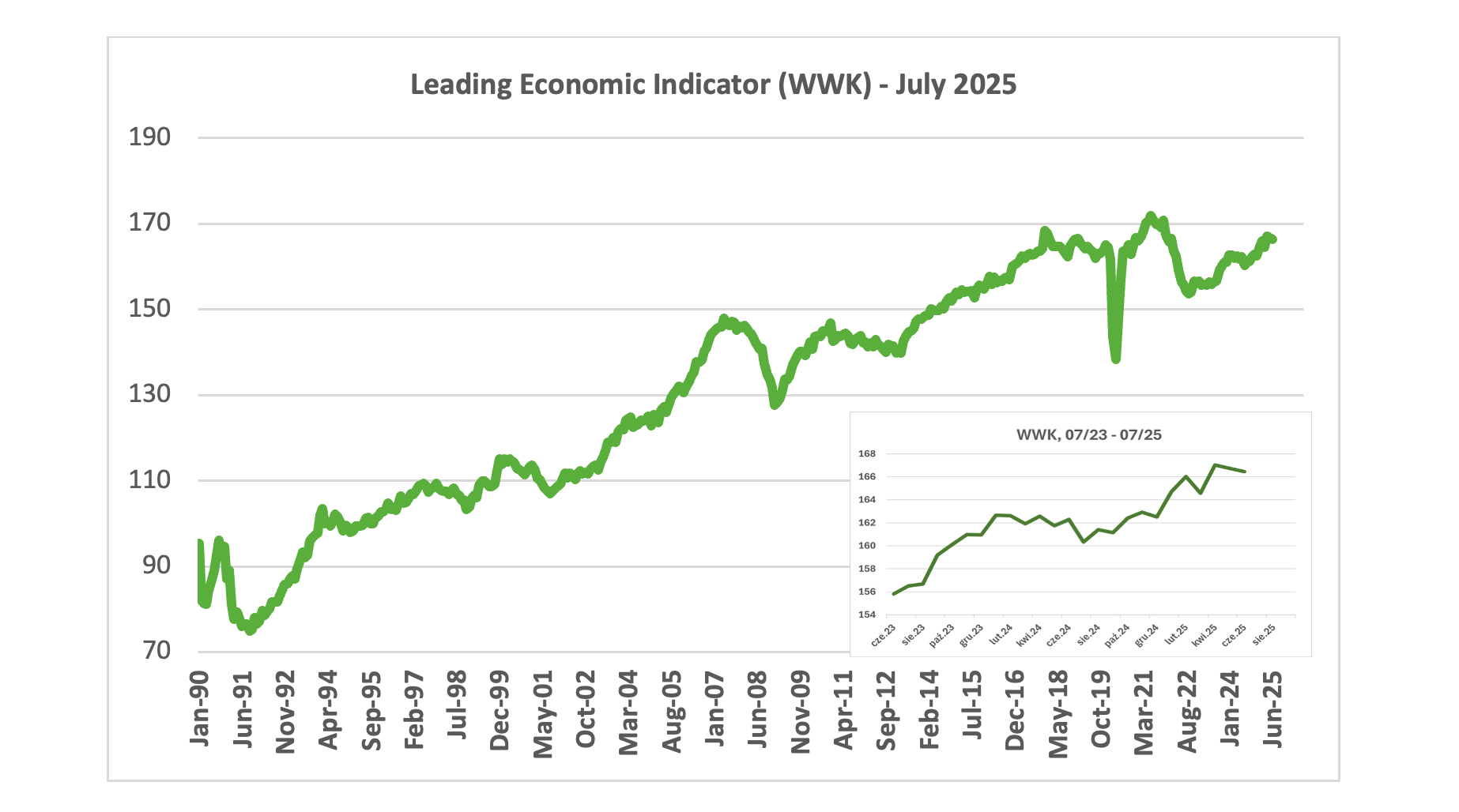

Poland’s Leading Economic Indicator (WWK), a composite index that provides early signals on the direction of the economy, recorded a second consecutive monthly decline in July 2025, dropping by 0.3 points month-over-month, according to data published by the Central Statistical Office (GUS) and the Economic Institute of the Polish Academy of Sciences. The primary factor behind this decline was a notable reduction in the volume of new orders received by manufacturing companies, which has in turn led to slightly weaker financial performance across the sector. Among the eight components of the WWK, two registered improvement, four remained unchanged, and two—new industrial orders and export orders—deteriorated. Export orders, in particular, saw the steepest decline. According to the GUS survey data, the share of companies reporting a decrease in export orders surpassed those reporting an increase by over 18 percentage points in July. This figure represents a worsening compared to March 2025, when the gap was just 10 percentage points. The temporary recovery seen in April had been confined to a few sectors—such as automotive, chemicals, metals, and textiles—but this rebound proved short-lived. Domestic orders, on the other hand, have shown prolonged stagnation, with little movement for more than a year. Approximately 19 of the 22 surveyed industries reported a greater share of firms experiencing a decline in new orders than those reporting growth. The most affected sectors include producers of durable consumer goods such as furniture, textiles, and leather products. The data suggest that post-pandemic surges in household durable purchases, particularly in 2020 and 2021, have now been fully absorbed, limiting the scope for new domestic demand. Additional data from GUS’s July 2025 business climate survey suggest that around 13 percent more companies are experiencing a reduction in orders than an increase, a margin that has remained stable compared to the same period last year. Stagnation in residential construction and weakened consumer interest in new credit further reinforce expectations of subdued domestic demand in the short term. The export environment also presents growing concerns. Beyond the fall in orders, survey responses indicate a perceived loss of competitiveness for Polish producers on both domestic and foreign markets. In July, more firms reported difficulties competing with imported goods locally and noted declining competitiveness outside the EU. Contributing factors include stagnant labor productivity and persistently high business costs. Despite these negative trends in orders and competitiveness, the financial impact on businesses has so far remained modest. Only a 2-percentage-point deterioration in financial performance was observed compared to June, and the overall business sentiment fell by just 1 percentage point. Analysts interpret this as a sign that many companies still have liquidity buffers or reserves from prior periods and currently view the downturn as temporary. On a more optimistic note, the Warsaw Stock Exchange continues to show strength. The main WIG index has sustained an upward trend through mid-2025, signaling continued investor confidence despite underlying weaknesses in industrial demand. While firms are cautiously optimistic that current conditions are transient, the lack of a broader recovery in domestic or export demand, alongside competitiveness challenges, poses a risk to Poland’s industrial momentum heading into the final months of 2025. Source: BIEC and GUS