2025-07-29

indicators

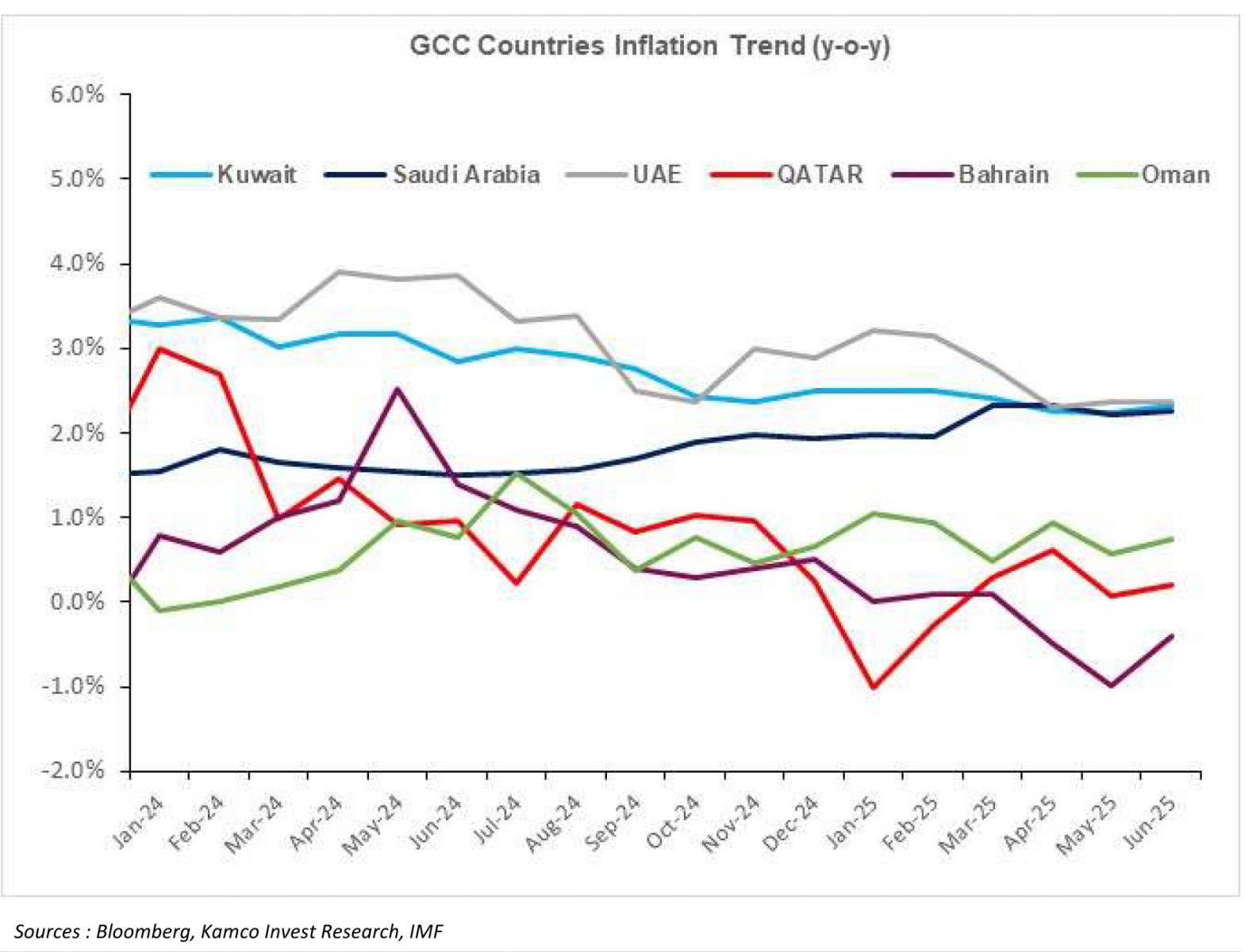

Despite geopolitical tensions and international trade disruptions, inflation across the Gulf Cooperation Council (GCC) countries remained relatively stable in the second quarter of 2025, according to the latest GCC Inflation Report published by Kamco Invest. The report notes that average inflation in the GCC dropped to 1.7% in 2024, down from 2.2% in 2023, highlighting the region’s resilience amid rising global costs and a volatile oil market. Brent crude oil prices rose to nearly USD 79 per barrel during the recent Middle East conflict but later fell to USD 68.4, a drop of 8.3% from end-2024 levels, as OPEC+ moved to unwind output cuts . One of the stabilizing factors was the gradual pass-through of global commodity and shipping cost increases, along with ongoing sound economic policies that helped contain inflation, unlike the sharper price pressures seen in the U.S. and Eurozone. In contrast, U.S. inflation accelerated to 2.7% year-on-year in June 2025, the highest in five months, while the Eurozone posted 2.0% inflation in the same period . Country-Level Trends • Kuwait recorded a 2.3% inflation rate in June 2025, driven by a 5.1% rise in food and beverages and 3.9% in clothing and footwear. Transportation costs fell by 1.8%, offsetting some of the increases . • Saudi Arabia also saw 2.3% inflation, its highest in two years, mainly due to a 6.5% increase in housing-related costs, particularly rent, which climbed by 7.6%. Prices for meat and poultry also rose by 2.4% . • United Arab Emirates reported 2.4% inflation in Dubai, with housing costs up 6.6% year-on-year. Transport costs, however, declined by 7.4%, helping to cap overall inflation . • Qatar’s CPI rose by only 0.2%, as price gains in food and communications were offset by a 3.6% drop in housing costs . • Bahrain experienced a 0.4% annual CPI decline, the lowest inflation in the region, attributed to falling prices in housing and food. The IMF projects Bahrain’s inflation to average just 1.0% in 2025, the lowest in the GCC . • Oman posted 0.8% inflation, with a notable drop in food prices (vegetables down 8.1%, seafood down 3.8%), despite modest increases in services and transport costs . Monetary Policy and Outlook The inflationary outlook across the GCC remains modest, with the IMF projecting 2025 inflation rates between 1.0% and 2.5% for all member states. Central banks in the region are closely aligned with U.S. monetary policy due to dollar pegs, except Kuwait, which operates a basket-linked currency. As the U.S. Federal Reserve holds rates steady due to tariff-related inflation, the GCC has largely maintained or modestly adjusted interest rates in response . With price stability supported by prudent fiscal policies, controlled food prices, and declining transport costs in many member states, the region is expected to maintain low inflation levels through the remainder of 2025, despite external risks.