2025-07-30

indicators

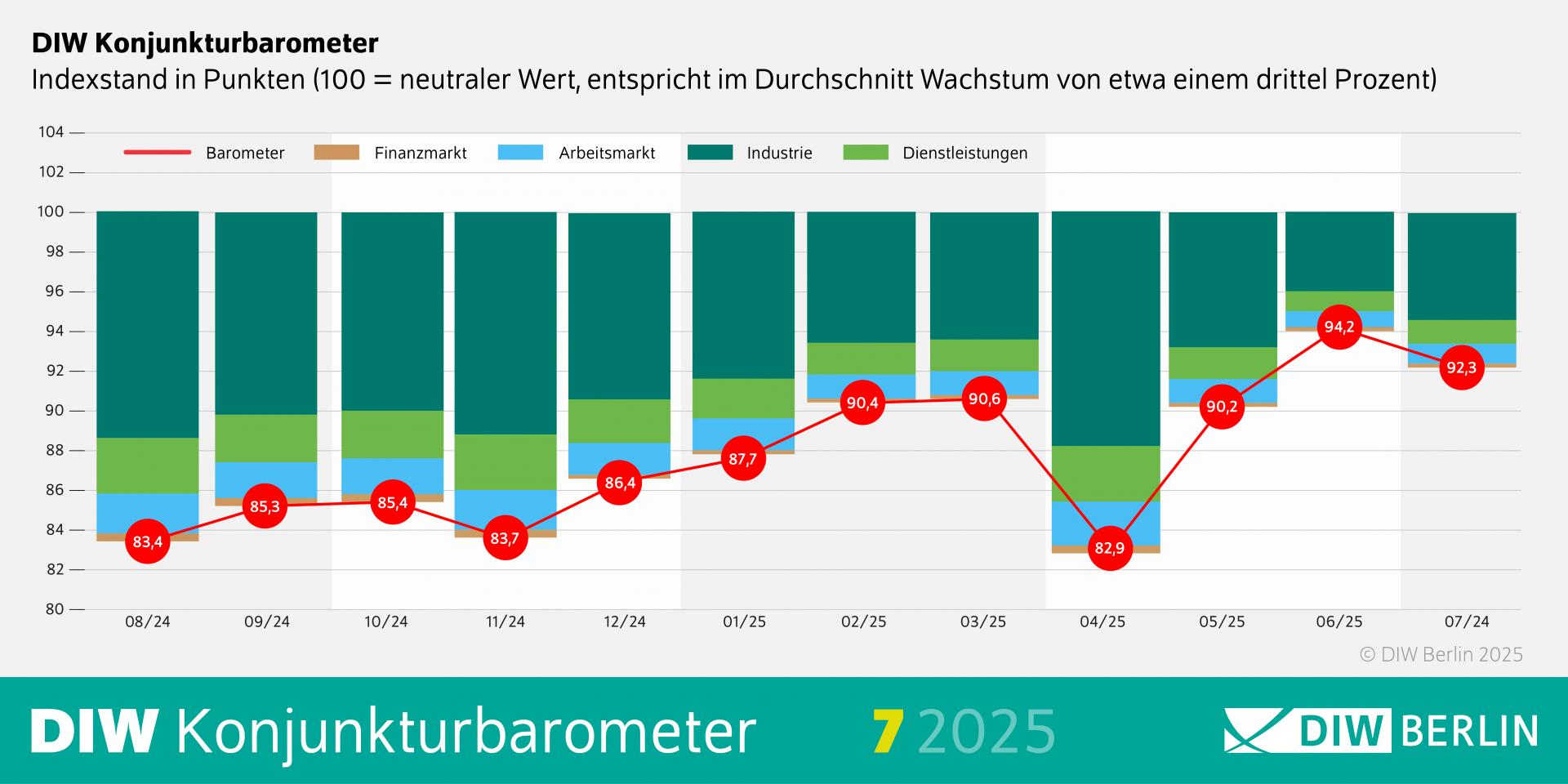

Germany’s economic recovery remains uneven, according to the latest data from the German Institute for Economic Research (DIW Berlin). The DIW Economic Barometer for July dropped slightly to 92.3 points, down from 93.2 in June, moving further below the neutral 100-point benchmark that signals average economic growth. While June had marked a two-year high, July’s decline underscores continued volatility. DIW’s Chief Economist, Geraldine Dany-Knedlik, stated that the recovery is proceeding as anticipated, but not without disruptions. She noted that a temporary boost in exports during the first half of the year—prompted by anticipated tariff hikes from the United States—has now faded. Meanwhile, recently announced investment measures aimed at stimulating public and private spending are expected to have a delayed impact. Germany’s export sector is under pressure from structural challenges, including declining international competitiveness and persistent trade policy tensions. Although a recent agreement between the European Union and the United States has helped reduce immediate uncertainty, its long-term stability and implications remain unclear. According to Dany-Knedlik, this environment of unpredictability is likely to encourage continued caution among businesses and consumers. German industry has shown signs of modest improvement since the downturn experienced last winter. Industrial production increased in May, but order intake remains low. Government investment packages may support higher order volumes in the future, although concerns about high production costs and weak global competitiveness persist. The ifo Business Climate Index showed a slight improvement in July, suggesting that clearer policy signals are helping firms with planning and forecasting, despite ongoing tariff effects. The services sector has yet to show meaningful signs of recovery. Retail activity has been stagnant, and consumer sentiment remains subdued amid ongoing labour market pressures. Job security and income stability remain top concerns, contributing to weak household spending. Analysts expect that any noticeable rebound in consumption is unlikely before 2026. Economic expert Guido Baldi of DIW Berlin suggested that Germany will need to remain patient as it waits for momentum to build. He highlighted the broader geopolitical context as a continuing constraint but noted that forthcoming government investments could begin to produce tangible economic benefits in the near term. Source: DIW Berlin