2025-07-30

residential

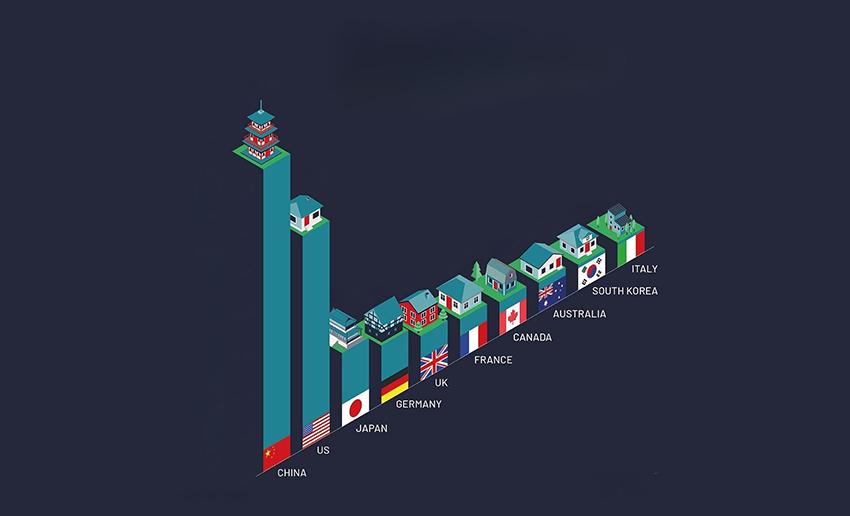

The global residential real estate market was valued at approximately €260 trillion (CZK 6,500 trillion) at the end of 2024, according to an analysis by Savills World Research. This marks a 2.7% year-on-year decline, yet the total value remains 19% above pre-pandemic levels recorded in 2019, reflecting long-term growth trends following the COVID-19 recovery period. Despite the annual drop in total value, the majority of countries saw an increase in residential real estate driven by rising property prices and expanding housing stock. The Czech Republic is positioned 34th globally, with an estimated residential property value of €1 trillion (roughly CZK 25 trillion), based on Savills data. China and the United States continue to dominate the global residential landscape. China accounts for 29% of the total value, while the U.S. contributes 18%, which represents a 5.1% increase compared to the previous year. Other top-ranking countries include Japan, Germany, the United Kingdom, France, Canada, Australia, South Korea, and Italy. Together, these ten markets make up 71% of the global residential real estate value. Australia and Italy are among the latest entrants into the top ten. Australia rose from 11th place in 2019 to 8th in 2024, while Italy advanced from 12th in 2022 to 10th in 2024. Within Europe, the Netherlands and Spain have also made notable gains. The Netherlands climbed from 19th to 15th position between 2019 and 2024, and Spain moved up from 20th to 17th, largely due to constrained housing supply pushing up property prices. Paul Tostevin, Head of Savills World Research, noted that while increasing residential value may reflect economic growth and market expansion, it can also be indicative of declining housing affordability in key global cities. Tostevin further emphasized that residential wealth remains unevenly distributed. Europe holds roughly 25% of the global residential real estate value despite comprising only 10% of the global population. Similarly, North America accounts for 22% of value while housing just 6% of the world’s population. In contrast, Asia and Africa, which are home to the largest shares of global population, hold significantly lower proportions of residential wealth. Savills highlights India as a prime example of untapped potential. Although it is the world’s most populous nation, India currently ranks only 16th globally in terms of total residential property value, underscoring the scope for future market expansion in rapidly developing regions. These findings illustrate not only the global concentration of residential wealth but also point to regions where demographic and economic shifts may drive future growth. The data underlines the enduring structural imbalances in global housing markets and the continued importance of policy measures to manage both supply and affordability. Source: Savills World Research