2025-07-30

finance

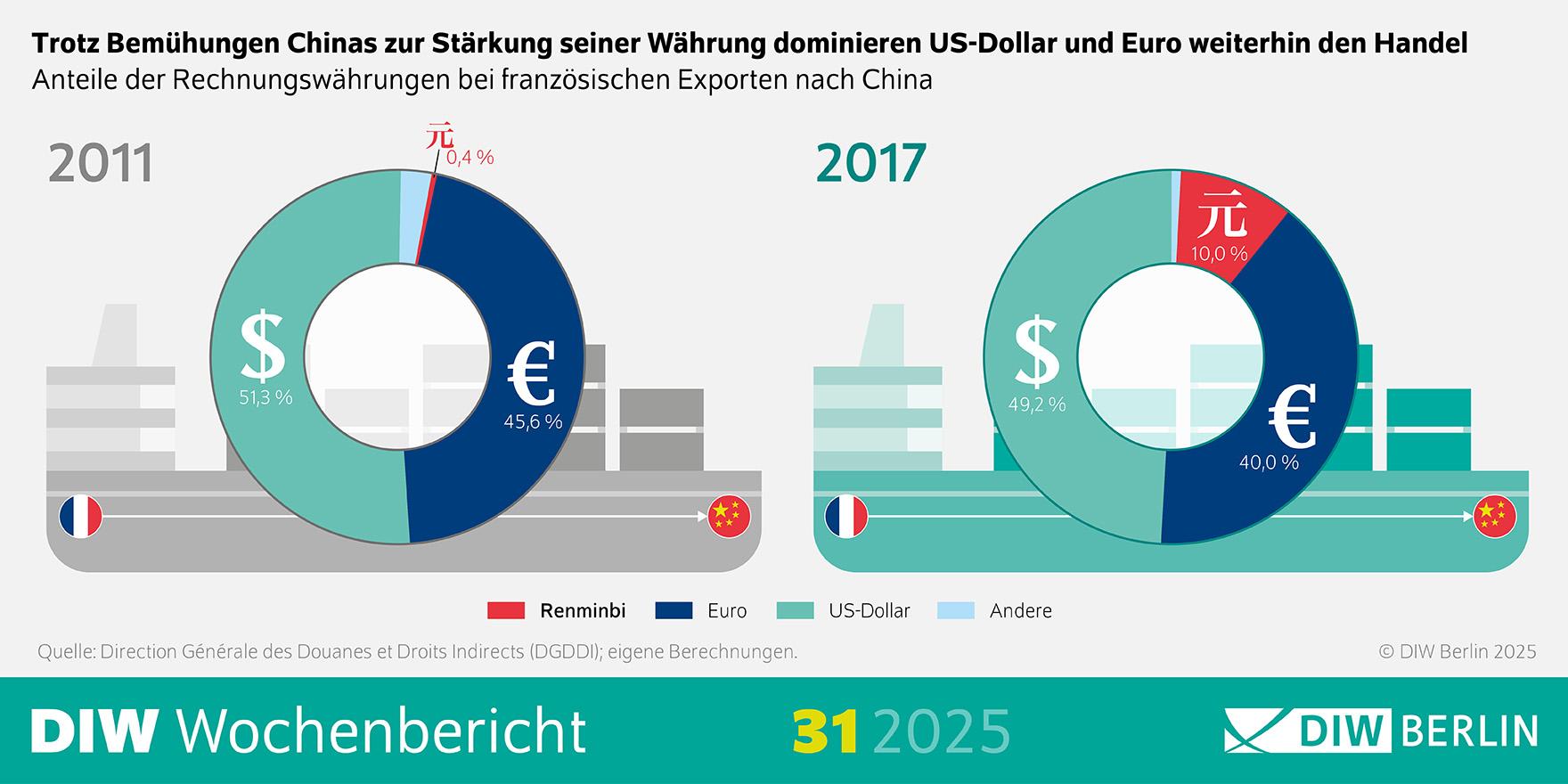

Efforts by the Chinese government to expand the international use of the renminbi have made limited headway in challenging the dominance of the US dollar and euro in global trade. According to a new study by the German Institute for Economic Research (DIW Berlin), while the renminbi has gained ground as a billing currency, its use remains mostly confined to transactions with China and varies significantly by sector. The study, authored by Sonali Chowdhry from DIW Berlin’s Business and Markets Department, analysed detailed French customs data covering the period 2011 to 2017—the early phase of China’s renminbi reforms. During this time, the share of French exports invoiced in renminbi rose from less than 1% to approximately 10%, primarily driven by firms in the consumer goods sector. However, the currency made little impact in sectors dominated by the US dollar, such as raw materials. Chowdhry notes that China’s long-term goal is to reduce reliance on the US dollar by increasing the use of its own currency in global trade. This objective aligns with China’s broader strategy to enhance its geopolitical position and lower transaction costs for domestic firms. Despite these efforts, the renminbi remains a marginal player globally. Of the French exports examined in the study, only 0.5% of renminbi-denominated invoices were used by firms without prior trading experience with China. Furthermore, 99% of all renminbi transactions were conducted exclusively with Chinese counterparts, indicating limited cross-border adoption beyond bilateral trade. The study also suggests that the euro could benefit from shifts in global currency preferences, particularly amid rising uncertainty in US economic policy. Chowdhry argues that the euro’s position could strengthen further if structural measures were introduced, such as wider access to euro liquidity through swap lines and the development of a digital euro to reduce transaction costs. While Chinese policymakers have made visible progress in promoting the renminbi, DIW Berlin concludes that the shift towards a multipolar currency system will be gradual and uneven across sectors and regions. The dollar and euro continue to dominate global trade invoicing, underscoring the entrenched nature of existing financial systems. Source: DIW Berlin