2025-07-30

logistics

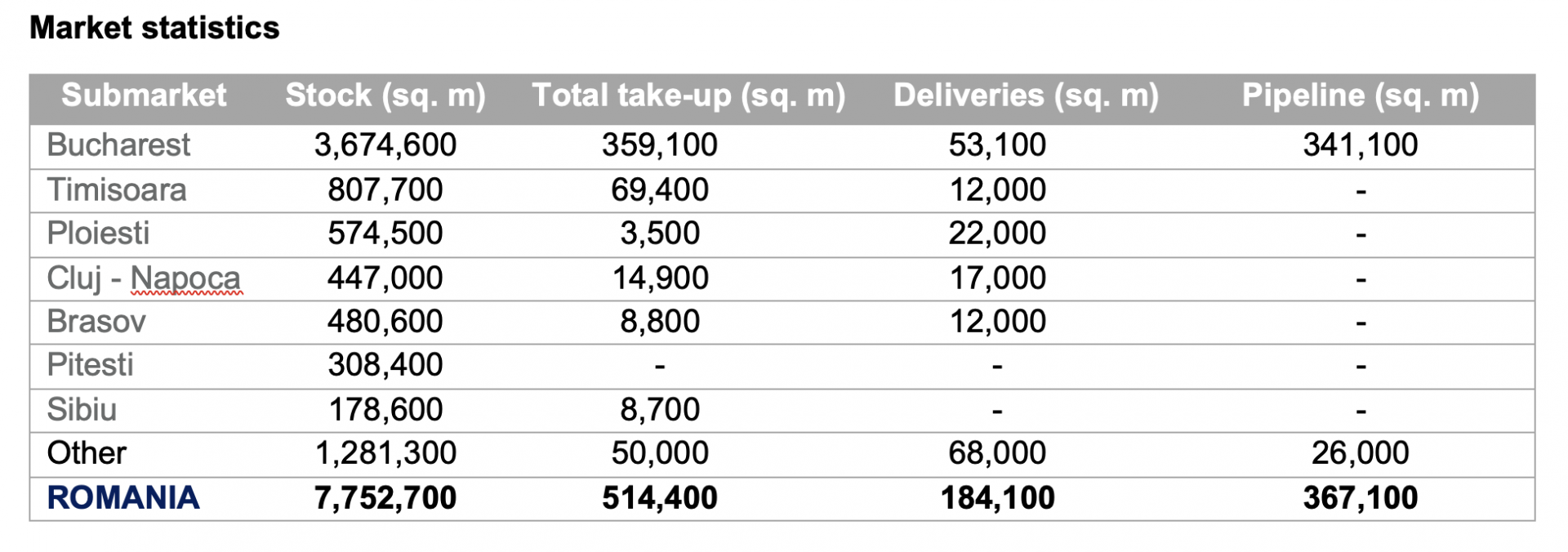

The Romanian industrial and logistics real estate sector recorded significant growth in the first half of 2025, with total leasing activity surpassing 500,000 square metres. According to the Romania Industrial Marketbeat Q2 2025 report by Cushman & Wakefield Echinox, this represents a 25% increase compared to the same period in 2024 and ranks as the third-best H1 performance since 2014. Leasing activity during this period was 45% above the average for the past 12 years. The strong performance in the first six months sets the stage for a potential full-year take-up volume approaching 1 million square metres, a threshold previously reached only in peak market years. Net take-up accounted for 66% of total leasing activity, reaching approximately 340,000 square metres. Bucharest remained the dominant location for leasing, representing 70% of the national total, with approximately 359,000 square metres leased. Timisoara followed as the second-largest logistics hub, capturing 13% of the total. Rodica Târcavu, Partner in the Industrial Agency at Cushman & Wakefield Echinox, noted that the sector’s resilience is particularly notable given the broader economic environment, which has been affected by a slowdown in industrial production. “Despite these challenges, the industrial and logistics market continued to expand due to strong domestic consumption,” Târcavu stated. She also highlighted that demand is increasingly led by logistics and retail operators, indicating a shift toward a distribution-centric model within supply chains. Manufacturing’s share, by contrast, was limited, reflecting broader trends in regional economic restructuring. The two largest lease agreements in Q2 2025 were renewals: Kyocera renegotiated 16,000 square metres in CTPark Timisoara Ghiroda, while Sarantis extended its lease for 11,000 square metres in WDP Park Dragomiresti. Logistics and distribution companies accounted for the largest share of leasing activity (160,000 square metres), followed by retail, e-commerce, and FMCG companies, which collectively leased 133,000 square metres. Manufacturing and automotive tenants represented a smaller portion of the market, contributing just under 6% of the total. At the end of the second quarter, Romania’s modern industrial and logistics stock stood at 7.75 million square metres. Developers delivered new projects totalling 184,100 square metres during the first half of 2025, marking a 77% increase over the same period last year. The national construction pipeline remains active, with approximately 370,000 square metres under development. Vacancy rates rose slightly to 5.8% nationwide, though this trend may reverse in the coming quarters due to limited speculative development. Prime rents in Bucharest have remained stable, but moderate increases were observed in other regional hubs such as Timisoara and Brasov. Asking rents in top-tier projects ranged between €4.30 and €4.70 per square metre per month in Q2. Cushman & Wakefield Echinox anticipates possible further increases by year-end, driven by rising construction and land acquisition costs. Source: Cushman & Wakefield Echinox