2025-08-05

indicators

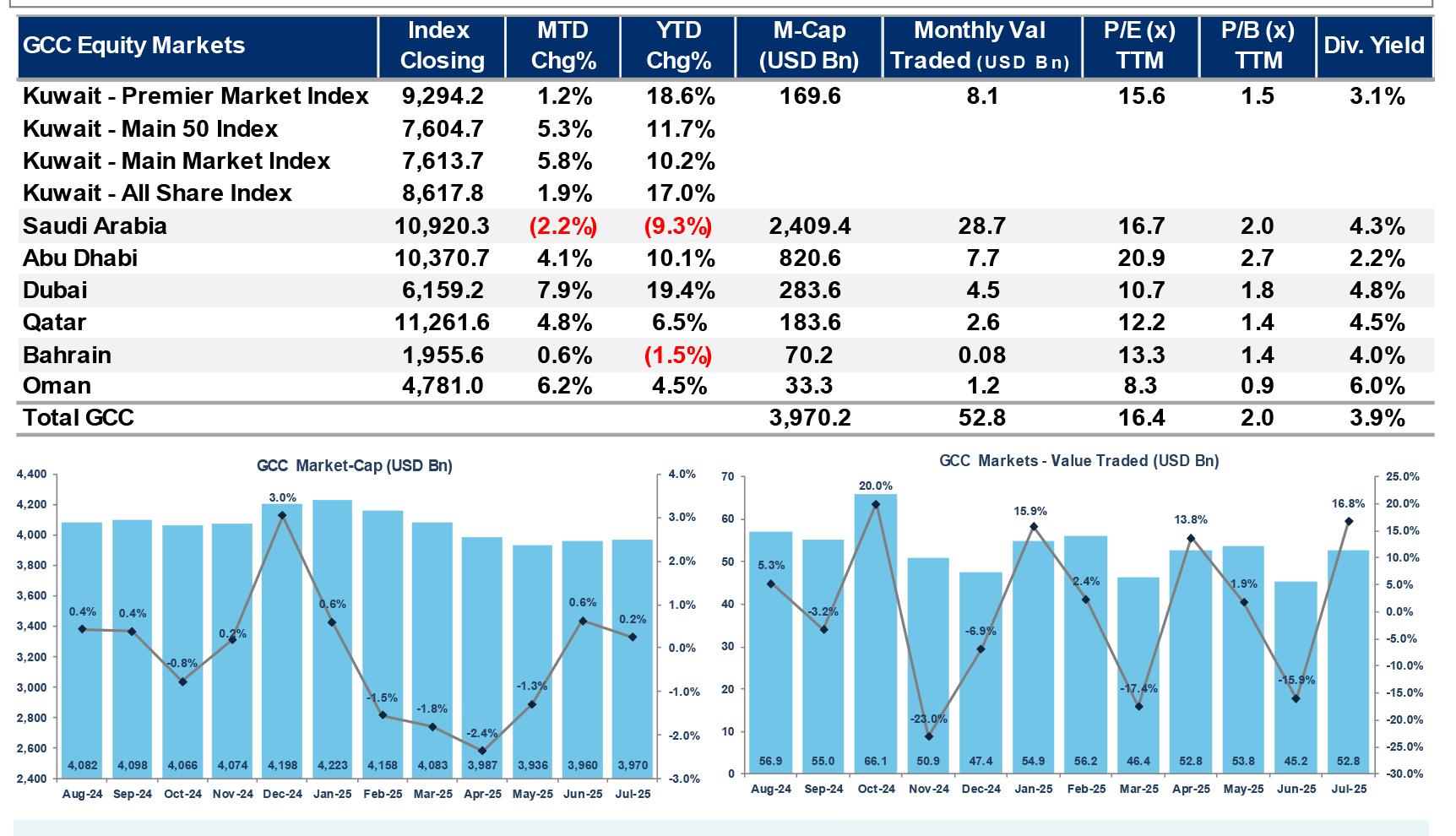

The Gulf Cooperation Council (GCC) financial markets displayed a steady performance in July 2025, as mixed global signals and regional developments shaped investor sentiment. According to Kamco Invest’s “GCC Markets Monthly Report – July 2025,” most GCC equity markets closed the month in positive territory, with Qatar, Abu Dhabi, and Dubai leading gains, while Bahrain and Oman registered declines. Qatar’s stock market posted the region’s strongest performance in July, gaining 8.1%, driven by robust earnings and growing investor confidence. Abu Dhabi’s ADX rose 3.6%, while Dubai’s DFM gained 3.3%, supported by positive corporate results and increased trading activity. In contrast, Bahrain’s market fell 1.2% and Oman dipped 0.5%, reflecting weaker investor sentiment in those markets. Saudi Arabia’s Tadawul index remained relatively stable, edging up by 0.4% for the month. The broader TASI index hovered near the 12,000-point mark, supported by strong earnings in the banking and materials sectors. However, trading volumes were mixed, and retail investor participation showed signs of moderation. Market capitalization across the GCC increased by $64.1 billion in July, with Saudi Arabia accounting for nearly 80% of the total monthly gain. Year-to-date, GCC markets have added around $167 billion in market capitalization. Sector-wise, the GCC saw strong gains in telecom, utilities, and capital goods, while the pharma and transportation sectors posted the steepest losses during the month. The telecom index led with an 11.2% gain. In the fixed income space, GCC sovereign bond yields tracked US Treasury trends, reflecting expectations of a prolonged period of high interest rates amid persistent inflation concerns. The US Federal Reserve maintained its policy stance in July, and markets adjusted expectations for a rate cut timeline accordingly. On the IPO front, Saudi Arabia continued to dominate GCC listings activity. The Kingdom hosted five IPOs in July alone, raising more than $1 billion. Key listings included Modern Mills Co. and Middle East Pharmaceutical Industries, underscoring investor interest in consumer and healthcare sectors. Kamco Invest’s report suggests that while macroeconomic uncertainties and interest rate dynamics remain in focus, GCC markets are likely to benefit from stable oil prices, strong fiscal positions, and ongoing economic diversification efforts. Investor attention in the coming months is expected to remain on corporate earnings, US economic policy, and regional listing activity.