2025-08-05

residential

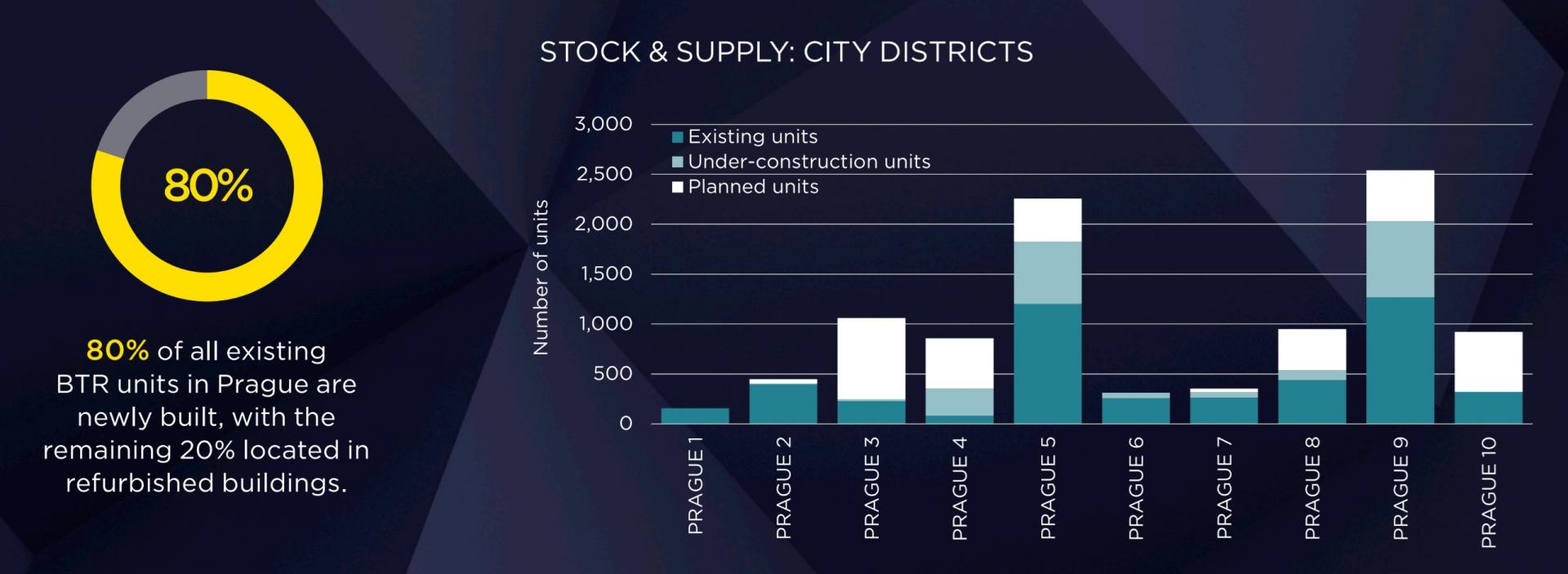

The institutional rental housing market in Prague is continuing to expand, driven by demand for professionally managed apartments and interest from long-term investors, according to Savills’ latest report on the city’s built-to-rent (BTR) sector. As of June 2025, there were 4,598 modern rental units across 81 projects in Prague, with the highest concentrations in Prague 9 and Prague 5. Most buildings are fully occupied, with waiting lists in place at some locations. The sector is primarily led by firms such as AFI Europe, Zeitgeist Asset Management, and the Archdiocese of Prague. Marek Pohl, Head of Valuation at Savills, notes that rental housing is viewed as a stable, long-term asset with flexible exit options, including the possibility of selling individual units. He also highlights its role in improving access to housing for those unable to afford ownership in central urban areas. After a high of 894 units completed in 2023, the pace of delivery has slowed. In 2024, 782 units were added to the market, and 448 more were completed in the first half of 2025. A further slowdown is anticipated, although development activity remains above pre-2021 levels. The market continues to be dominated by smaller-scale projects. Around 70% of developments include fewer than 50 units, and only 14 buildings offer more than 100. Studios and one-bedroom apartments make up nearly 80% of available rental housing. Two-bedroom units account for 18%, while three-bedroom apartments remain scarce at 4%. Rental prices for smaller units have remained steady, with monthly rents averaging CZK 19,900 for studios and CZK 27,400 for one-bedroom units. In contrast, larger apartments have seen increases of up to 15% year-on-year, with average rents for two-bedroom units at CZK 43,000 and three-bedrooms reaching CZK 68,000. Looking ahead, over 1,100 new units are expected to be delivered in 2026. There are currently 1,902 units under construction, with another 3,400 expected to break ground over the next two years. Despite near-term fluctuations, the sector continues to gain traction and is playing an increasingly important role in Prague’s residential landscape.