2025-09-16

finance

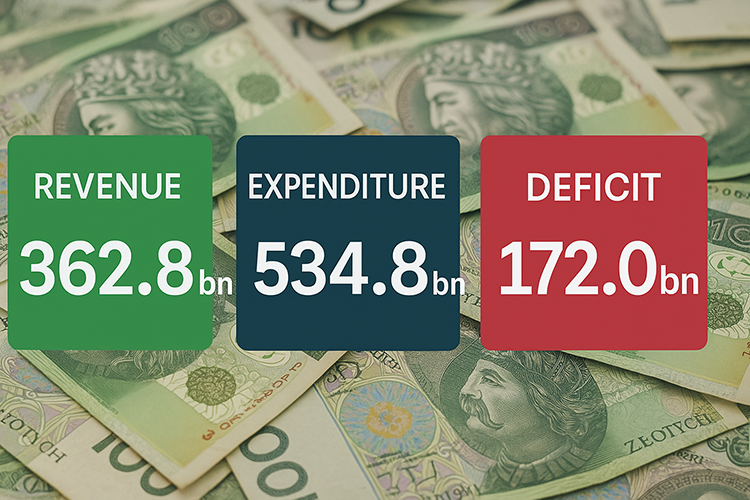

The Polish Ministry of Finance reported that by the end of August 2025, the state budget recorded revenues of PLN 362.8 billion and expenditures of PLN 534.8 billion, resulting in a deficit of PLN 172 billion. This represented 57.3% of planned revenues, 58.0% of planned expenditures, and 59.6% of the deficit limit set in the 2025 budget law. The fall in revenues compared with last year was primarily due to reforms in the financing of local government units (JST), which redistributed shares of personal income tax (PIT) and corporate income tax (CIT). Without this reform, state budget revenues would have amounted to PLN 484.9 billion, nearly PLN 40 billion higher than in the same period of 2024. Tax revenues totaled PLN 311.2 billion, down 12.2% year-on-year. VAT receipts grew by 10.5% to PLN 214.6 billion, and excise duty revenues rose 1.9% to PLN 59.1 billion. PIT revenues fell sharply to PLN 11.3 billion due to the transfer of a larger share to local governments, while CIT revenues increased 5.8% to PLN 44.1 billion. Non-tax revenues amounted to PLN 40.7 billion, 5.1% lower than in the same period last year. Expenditures of PLN 534.8 billion were up 7.4% compared with January–August 2024. Significant outlays included PLN 112 billion for the Social Insurance Institution, PLN 63.2 billion for national defence, PLN 41.6 billion for servicing state debt, PLN 36.6 billion in general subsidies for local governments, and PLN 32.5 billion for health. Transfers included PLN 19 billion in March for repayment of Polish Development Fund bond obligations from the 2020 financial support programme, and PLN 16 billion in July to the COVID-19 Countermeasure Fund for liabilities issued between 2020 and 2023. Higher year-on-year expenditure was reported in healthcare, social insurance, national defence, debt servicing, transport, EU contributions, internal affairs, and higher education. The health budget alone grew by PLN 19.2 billion, partly due to increased transfers to the National Health Fund and new programmes such as support benefits for people with disabilities and the “widower’s pension.” Defence spending rose by PLN 4.8 billion, reflecting purchases of equipment and armaments. General subsidies to local governments decreased by PLN 50.3 billion compared with 2024, reflecting structural changes in public finances. Since January 2025, the subsidy has had a complementary role, as JSTs now receive a larger share of PIT and CIT revenues directly. The Ministry highlighted that despite the deficit increase, revenue shortfalls were largely statistical, caused by the redistribution of PIT and CIT shares, while underlying tax bases, particularly VAT and CIT, continued to grow.