2025-09-19

finance

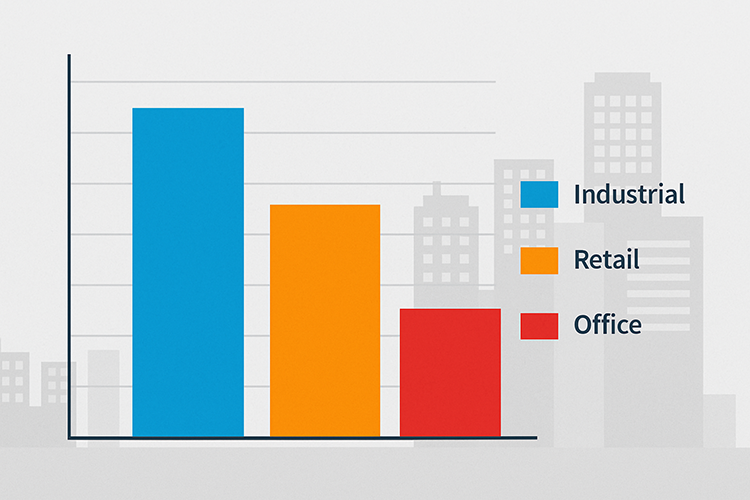

Poland’s commercial real estate (CRE) market recorded investment turnover exceeding €1.5 billion in the first half of 2025, down 11% compared with the same period last year, but supported by the highest number of transactions since 2021. A total of 61 deals were signed, reflecting a particularly active market despite lingering macroeconomic headwinds. The industrial sector was the standout performer, generating €694 million in investment—nearly 140% more than in H1 2024. Much of this growth was driven by sale-and-leaseback transactions, which have become a key source of liquidity for corporates and an attractive long-term income product for investors. The largest deal was Realty Income’s €253.5 million purchase of two Eko-Okna factories, marking the biggest sale-and-leaseback agreement in Central and Eastern Europe. Other notable deals included the sale of LPP’s distribution centre in Bydgoszcz to Reico Long Lease Fund and Adventum International’s acquisition of four industrial assets in Silesia. The office market remained more subdued, with total investment reaching €414 million—about half of H1 2024 levels. However, transaction activity was high, with 23 deals recorded. Warsaw accounted for 53% of the volume, led by UNIQA Real Estate’s €69 million acquisition of Wronia 31 in the Wola district. Regional cities also saw strong activity, particularly Kraków and Wrocław, where Scandinavian investors such as NIAM and Stena RE remained active. Yields for prime Warsaw offices held steady at 6.0%. Retail saw 23 transactions worth €314 million, dominated by retail parks and smaller shopping centres. Czech newcomer MyPark acquired the A-Centrum Portfolio of 10 retail parks for €54 million, while BIG Poland expanded with the acquisition of Power Park Olsztyn. Wrocław also saw renewed investor interest, with Vastint purchasing the Arkady Wrocławskie complex from Develia for €43 million. Prime yields for shopping centres remained stable at 6.5%, while prime retail park yields compressed to 7.2%, reflecting strong investor demand. In the living sector, activity is gathering momentum after two weak years. Xior Student Housing completed acquisitions in Warsaw and Wrocław worth nearly €70 million, while financing conditions improved following two rate cuts by the National Bank of Poland, which lowered its reference rate to 5.0% by July 2025. Poland’s broader economy provides a supportive backdrop. GDP growth is forecast at 3.3% for 2025, inflation is expected to ease to 3.6%, and unemployment remains among the lowest in the EU at 2.8%. With financing costs declining and demand for resilient asset classes—particularly industrial and retail parks—continuing, analysts at JLL, Cushman & Wakefield, and Savills all note that Poland retains its yield premium compared with Western Europe, offering attractive entry opportunities for both regional and international investors. Looking ahead, domestic private investors and regional capital from Central Europe are expected to remain dominant players, though a gradual return of Western institutional capital is anticipated as borrowing costs stabilise and prime assets come to market.