2025-09-30

markets

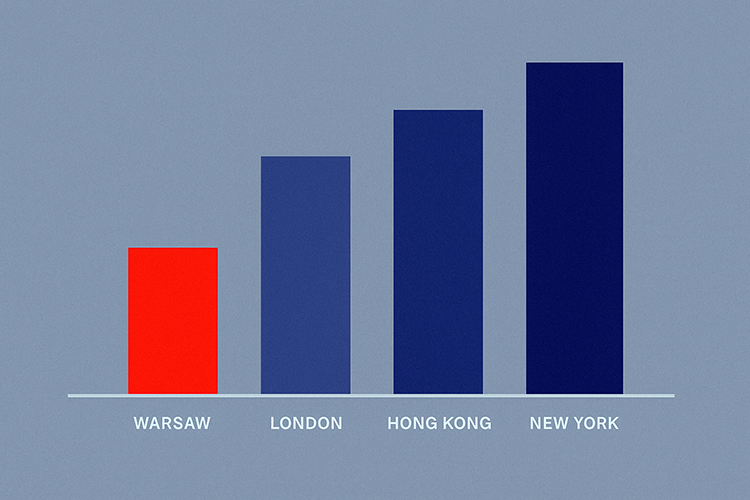

The global market for prime office space continues to show resilience, with recent data pointing to rising rents and heightened competition for the best buildings. According to Savills’ Global Occupier Markets: Prime Office Costs Q2 2025, the average cost of leasing top-tier space increased by 0.7% quarter-on-quarter and by 3.4% year-on-year. The upward pressure reflects a broad trend: occupiers are increasingly willing to pay for quality locations, sustainable design, and advanced technological features that align with modern working models. Other professional sources confirm this trend. Cushman & Wakefield’s DNA of Real Estate report for Q2 2025 found that prime office rents globally grew by 1.1% compared with the previous quarter and by 4.2% year-on-year, with more than 90% of markets they track showing either stable or positive rental growth. CBRE also reports a widening gap between top-tier and lower-grade properties, with prime rents climbing while older, less flexible buildings face falling demand. Technology and ESG compliance have become central to the competitive positioning of premium offices. PropTech and AI applications are now standard in many advanced markets, ranging from digital building management systems and occupancy sensors to predictive maintenance and customised tenant services. While these features often raise short-term operating costs, Savills notes that they are increasingly essential for securing long-term leases with corporate clients. Fit-out costs also play a growing role in overall occupier expenses. Tenants expect plug-and-play flexibility, high-quality acoustics, and wellness features, all of which push costs upward. As Jakub Jędrys of Savills in Poland observes, anticipating future tenant needs at the design stage is becoming a key differentiator for investors. Regional data highlights the varied pace of growth. In Europe, Prague saw one of the steepest quarterly increases in prime costs at 3.1%, driven by a limited pipeline of new projects. In Germany, JLL reports that prime rents in Munich rose 12% year-on-year to €58 per square metre per month, underscoring strong demand in a supply-constrained market. By contrast, Warsaw remains one of Europe’s most cost-competitive capitals. BNP Paribas Real Estate notes that prime asking rents in the city centre remain between €22.50 and €28.00 per square metre per month, even as service charges have risen above PLN 40 per square metre. JLL adds that Warsaw recorded 63,000 square metres of net demand in Q2, with total leasing volumes of 155,000 square metres, showing that occupier activity remains robust. Globally, cost increases were most pronounced in Kuala Lumpur (+4.4% quarter-on-quarter), Melbourne (+3.4%), Miami (+3.4%) and Sydney (+2.7%), according to Savills. Meanwhile, established financial hubs such as London, Hong Kong and New York remain in a league of their own, with prime rents several times higher than those in Central and Eastern Europe. Analysts caution, however, that the next phase of growth will be shaped as much by supply constraints as by occupier demand. CBRE’s outlook for 2025 anticipates only moderate rent growth across Europe, in the range of 2.5–3.0%, as macroeconomic conditions stabilise. At the same time, developers are under pressure to deliver buildings that are both ESG-compliant and adaptable to rapid shifts in workplace technology. Taken together, the findings suggest that premium offices are no longer judged only by their address but by how well they combine design, technology, and sustainability. As Daniel Czarnecki of Savills Poland puts it, “Tenants expect offices that actively support their operations and reflect the realities of hybrid work, ESG commitments and rising expectations of workplace quality.”