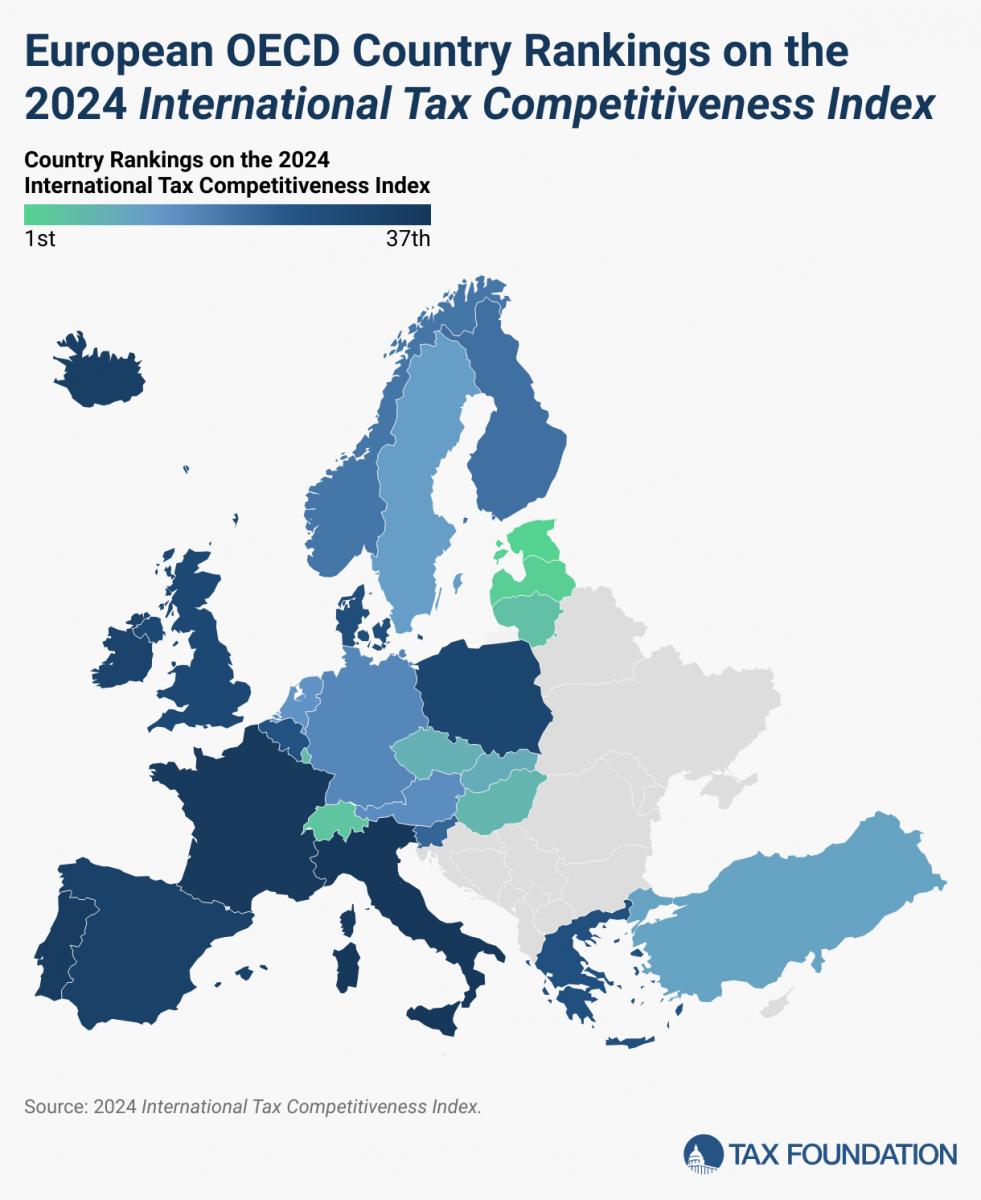

Poland ranks 31st among 38 OECD countries in 2024 Tax Competitiveness Index

Poland has been ranked 31st out of 38 countries in the 2024 OECD Tax Competitiveness Index, improving by two places from last year, according to a report. The top countries in the ranking include Estonia, Latvia, New Zealand, and Switzerland, while Colombia, Italy, and France were placed at the bottom for their tax competitiveness.

The Tax Competitiveness Index (ITCI) assesses countries based on how their tax systems promote neutrality and competitiveness. The report highlights both strengths and weaknesses of Poland’s tax policies.

Among the strengths of Poland’s tax system are:

• A corporate tax rate of 19%, lower than the OECD average of 23.9%.

• An extensive network of double taxation agreements with 87 countries.

• Corporate capital relief, limiting tax preferences based on debt.

However, the report also points out significant weaknesses, including:

• Multiple property taxes that separately affect real estate transactions, assets, banking assets, and financial transactions.

• Limited capacity for companies to offset net operating losses against future profits and no ability to use losses to reduce past taxable income.

• Companies in Poland can only deduct 33.8% of the real costs of industrial buildings, compared to the OECD average of 47.2%.

According to the OECD, corporate taxes are the most detrimental to economic growth, followed by personal income taxes and consumption taxes. Property taxes are seen as having the least impact on growth. Additionally, tax regulations that remain neutral, avoiding preferences for consumption over saving, tend to support more balanced economic activity.

The report emphasizes that as tax systems become more complex, their neutrality diminishes, potentially harming economic performance.

The Warsaw Enterprise Institute (WEI) has suggested that comprehensive tax reforms could significantly improve Poland’s ranking, potentially raising it to 14th place. The WEI’s “Agenda Polska 2030” report proposes reforms such as unifying VAT rates, replacing personal income tax (PIT) with a uniform payroll tax, and overhauling corporate income tax (CIT) with a new tax on corporate income.

“Reforming the PIT, CIT, and VAT systems could also increase fiscal revenues in the long term, contributing to greater financial stability for Poland,” the WEI concluded.

Source: OECD and ISBnews