Polish Non-Bank Loan Market Expands in August with Growth Across All Segments

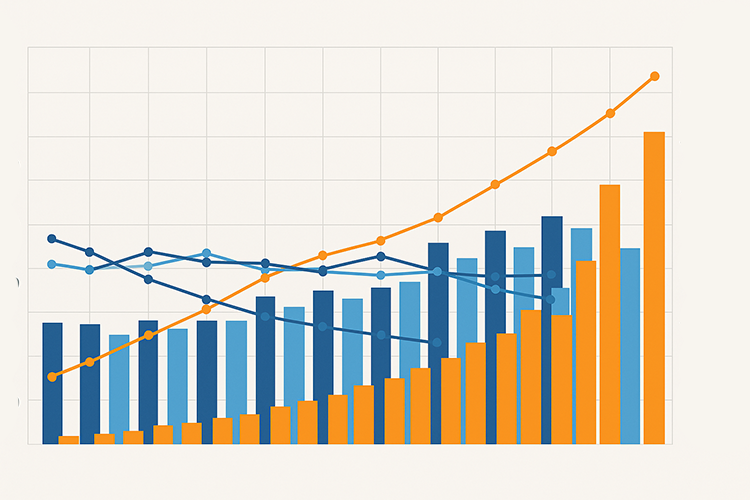

Poland’s non-bank lending sector recorded strong gains in August, with both short-term and longer-term cash loans, as well as installment loans, rising in number and value compared with the same month last year.

According to data from the Credit Information Bureau (BIK), the largest increases were seen in short-term cash loans, which are typically repaid within two months. These reached a value of just over PLN 1.15 billion in August, nearly 21 percent higher than a year earlier. Around 464,000 such loans were issued during the month, up by more than 7 percent year-on-year. The average loan size also increased, climbing to about PLN 2,700.

Loans with maturities longer than two months also advanced, with more than 74,000 granted in August, worth roughly PLN 441 million. Both the number and value of these loans grew compared with last year, while the average size rose to just over PLN 6,000.

The installment loan segment also showed strong momentum, with almost 873,000 loans granted during the month. Their total value came to PLN 582 million, reflecting a rise of more than 15 percent. However, the average installment loan size dropped by nearly 10 percent, to about PLN 670, suggesting that many borrowers are opting for smaller amounts even as overall demand rises.

Cumulative figures for the first eight months of the year highlight the strength of the sector. More than 3.6 million short-term cash loans were issued between January and August, up nearly 15 percent on the year, with the value growing by close to 29 percent. Longer-term cash loans and installment loans also recorded double-digit growth in both number and value.

Analysts note that while the market is expanding, the fall in average installment loan amounts and reports of high rejection rates across the industry suggest lenders are exercising caution. For now, though, the data confirms that Poland’s non-bank loan sector continues to grow rapidly, driven by both household financing needs and wider consumer spending trends.