Romania’s industrial and logistics stock to hit 8 million Sqm by 2025

Romania’s industrial and logistics space is on track to reach 8 million square meters by the end of 2025, provided the current annual development pace of 500,000 sq. m continues. As of mid-2024, more than 7.125 million sq. m were operational across the country, with over half of that stock concentrated in the Bucharest-Ilfov and West regions, according to a new report from real estate consultancy firm Cushman & Wakefield Echinox.

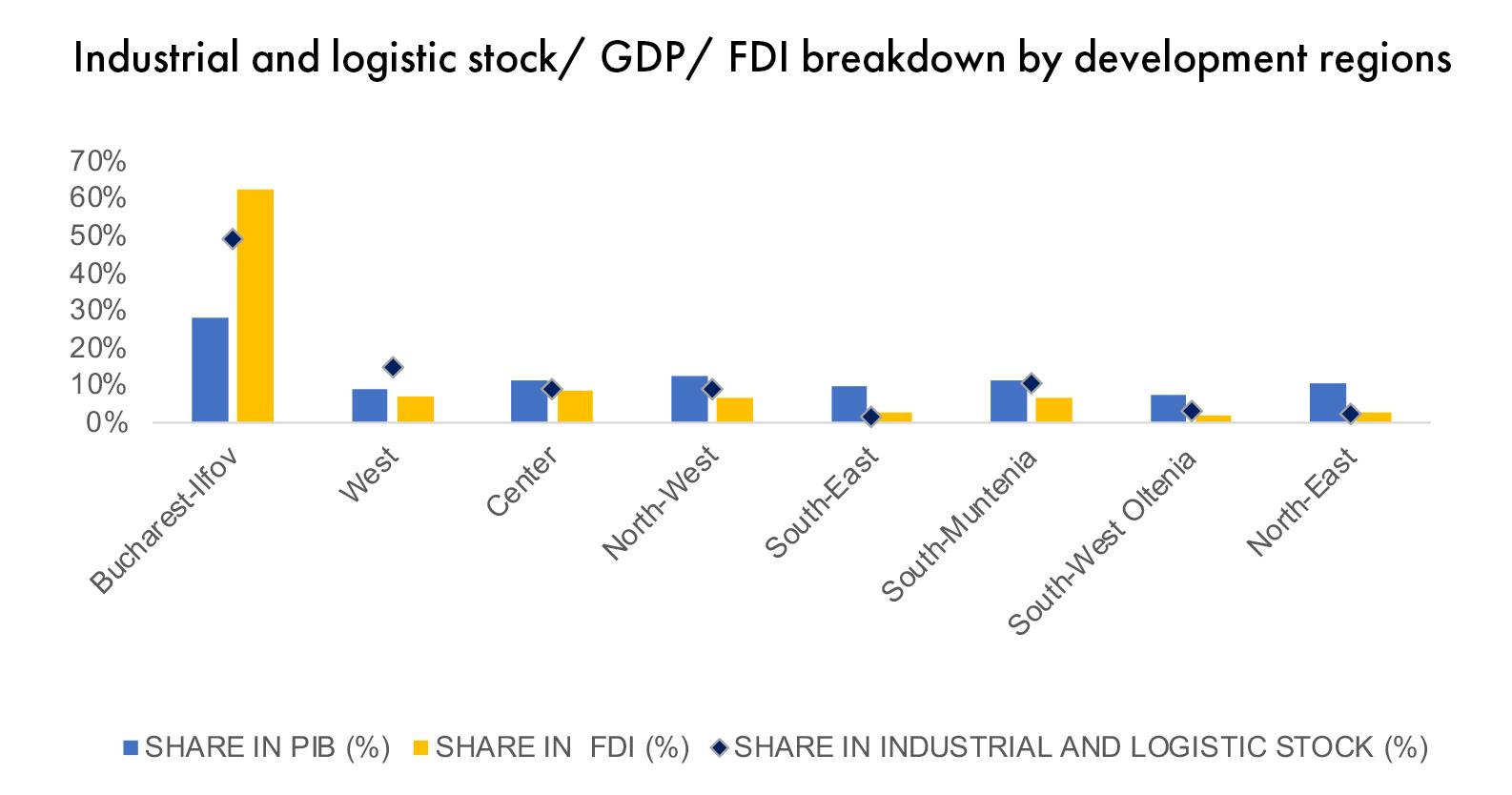

Despite the growing demand for logistics and industrial spaces across various regions, the Bucharest-Ilfov region remains dominant, accounting for 49.2% of the total stock, followed by the West region at 14.7%. Other significant hubs include South-Muntenia (10.6%), Center (9%), and North-West (8.9%). Meanwhile, the North-East (3.3%) and South-East (1.7%) regions remain the least developed, with stock levels in these areas comparable to that of Chitila, a small town near Bucharest.

The report forecasts that Romania’s 2024 new supply will reach around 500,000 sq. m, with over half of these new developments located in Bucharest-Ilfov, the West, and South-Muntenia regions.

“The gap between Romania’s eight development regions, in terms of GDP share and foreign direct investment, is reflected in the uneven distribution of industrial and logistics spaces,” said Vlad Saftoiu, Head of Research at Cushman & Wakefield Echinox. “This sector has greatly contributed to the success of areas with strong business growth and foreign investments. However, without addressing these regional economic disparities, it will be challenging to see significant surges in new supply.”

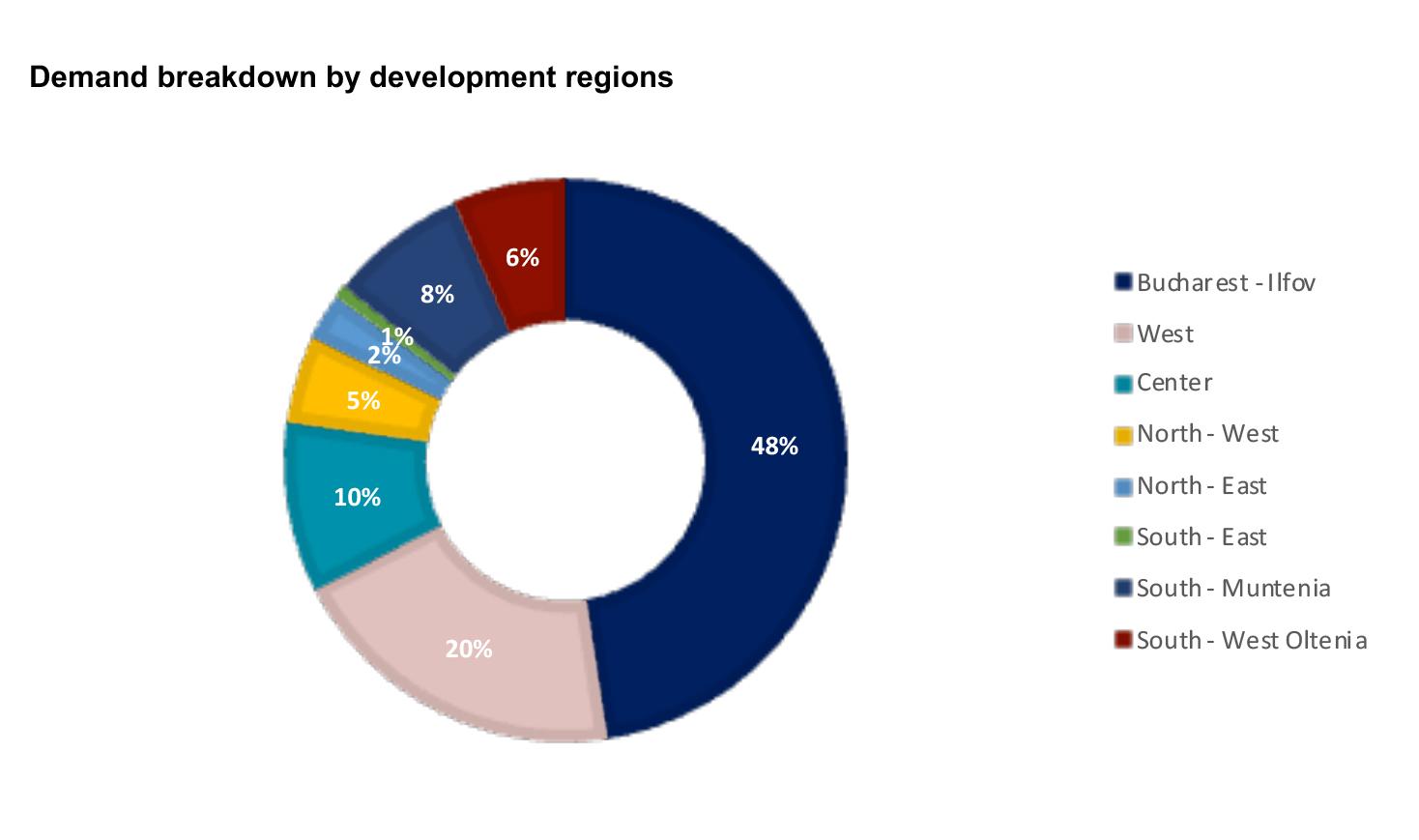

Transactional activity remained strong, with companies leasing about 1.5 million sq. m of industrial and logistics space between 2023 and the first half of 2024. During the same period, over 520,000 sq. m of new space was constructed, driving the national vacancy rate down to below 5%, creating development opportunities in regions with less industrial infrastructure.

Bucharest-Ilfov led the leasing activity with 48% of the total volume over the last 18 months, followed by the West region with 20%, and the Center region with 10%.

The largest owners of industrial and logistics spaces in Romania are CTP and WDP, who together control nearly two-thirds of the market, with a combined portfolio of almost 5 million sq. m. However, other developers, including VGP, ELI Parks, Logicor, and Oresa Industra, are increasingly expanding their presence. Additionally, a number of new players have announced plans to enter the Romanian market, with these investments expected to materialize by late 2024 or early 2025.

The industrial and logistics sector continues to be a cornerstone of Romania’s economic infrastructure, with its growth closely tied to the performance of the country’s strongest regions and the influx of foreign investment.