Czech construction sector sees modest growth, but building permits hit 25-year low

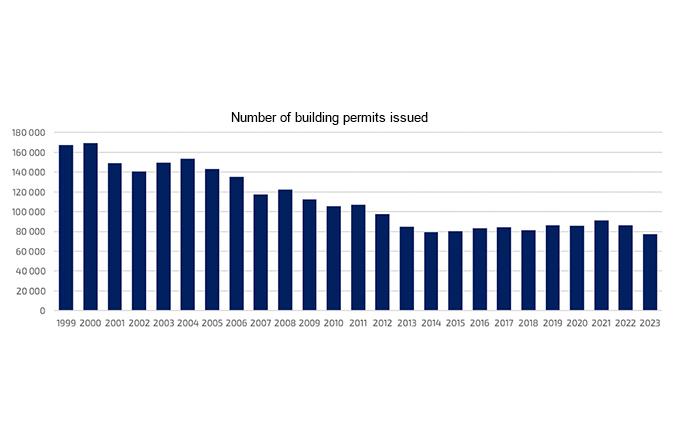

According to newly released data, construction output in July posted a modest 2% year-on-year increase. However, this positive result reflects just one month’s performance, and a broader look shows that the sector is far from healthy. Over the first half of the year, construction output dropped by 5.4% compared to the same period last year. The number of building permits issued in the first six months also plummeted, with only 37,208 permits granted, marking the lowest half-year figure in 25 years. Both residential and civil engineering projects, critical areas for the Czech Republic, experienced a steep decline.

Despite these challenges, there are signs that the construction industry may be slowly recovering. The residential market, particularly in Prague, saw a record year-on-year increase, with new apartment sales in the capital up by 112% in the first half of the year. Additionally, office construction in Prague has shown signs of revival after a two-year hiatus.

The new building law, though imperfect, is expected to contribute to a brighter future for the sector. The law, alongside the ongoing digitalization of building processes, holds the potential to bring positive changes. However, the transition to a digital system has been fraught with issues, leading some in the industry to call for a return to the old system. Such a move, experts warn, would be a step backward.

Between 1999 and 2005, the number of building permits consistently exceeded 140,000 annually. However, with the introduction of the previous building law in 2006, these numbers began to decline, eventually stabilizing between 80,000 to 90,000 permits annually by 2013. While the new building law and digitalization efforts have had a rocky start, reverting to the old system would stagnate progress in a sector crucial to the economy.

A thriving construction industry directly benefits the state and public budgets. Construction has one of the highest economic multipliers, with every crown invested in the sector returning threefold to the economy. For example, the state earns approximately CZK 1.25 million in VAT from the sale of an average new apartment in Prague, with additional contributions benefiting the city. With over 145,000 apartments planned in the capital, this could generate more than CZK 165 billion in VAT alone for the national budget, which is currently in dire need of revenue.

Source: Central Group