GARBE PYRAMID-MAP Report: Slowing growth in European logistics real estate

The era of rapid rental increases in Europe’s logistics real estate market appears to be coming to an end, according to the latest GARBE PYRAMID-MAP report. Prime rents in Europe’s top logistics markets rose by just 0.9% in the second half of 2024, equating to an increase of just €0.06 per square meter – from €7.30 to €7.36. This modest rise lags behind the eurozone inflation rate of 2.4%. While 2024 saw a slight year-on-year decline in take-up (-7%), the figures still surpassed pre-pandemic levels. The vacancy rate across Europe stood at just under 6%.

Market Consolidation Following Boom Years

“The slowdown in rental growth is primarily due to economic conditions in Europe,” explained Tobias Kassner, Head of Market Intelligence and Sustainability at GARBE Industrial Real Estate. “Many companies have paused expansion and are instead focusing on consolidation. The pandemic had triggered a surge in demand for logistics facilities, but that cycle has now concluded.”

Kassner also pointed to an increase in supply due to a lag between new developments and successful leasing. However, with construction activity slowing, the supply-demand gap is expected to narrow again.

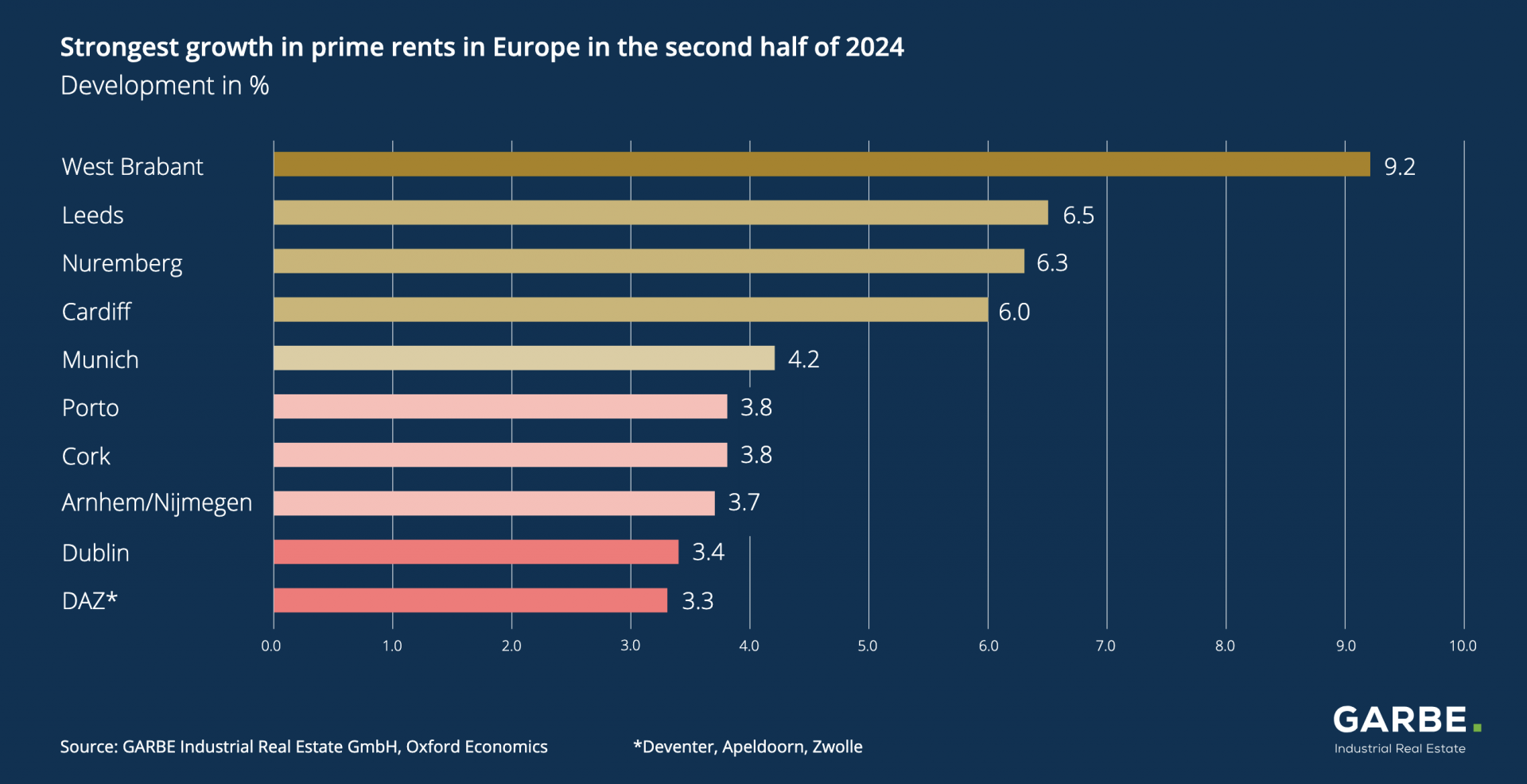

The study found that in over half (57%) of the 121 logistics submarkets surveyed, prime rents remained stable. An upward trend was observed in 35% of markets (42 submarkets), while only 10 regions saw rental declines. Among the biggest increases were Leeds and West Brabant, where rents rose by €0.60 per square meter, as well as Munich, Nuremberg, Cardiff, and London, which each saw increases of €0.50 per square meter.

Regional Variations and Market Trends

Germany’s logistics market saw minimal rental growth, averaging just €0.03 per square meter, with Munich and Nuremberg contributing to the slight increase. Several regions, including Fulda/Bad Hersfeld, Leipzig, Regensburg, Saarbrücken, Magdeburg, and Kassel, experienced a minor decline in prime rents, primarily due to speculative development and temporary oversupply in secondary markets.

“In Germany, we are seeing a stabilisation after years of dynamic growth,” noted Kassner. “While some Class C cities are facing a temporary oversupply, the overall market remains stable at a high level.”

Elsewhere, prime rents remained mostly unchanged in Italy, France, and Central and Eastern Europe (CEE), while Spain recorded a €0.05 increase. The most significant gains were observed in the United Kingdom (+€0.26) and the Netherlands (+€0.09), as both markets continued to demonstrate strong demand driven by high consumption rates and a resilient logistics sector.

Forecast: Moderate Growth Expected in the Years Ahead

GARBE, in collaboration with Oxford Economics, forecasts steady prime rent increases over the next five years across 30 major European logistics markets. Analysts project an average annual growth of 2.7%, or €0.24 per square meter, slightly outpacing the forecasted inflation rate of 2.4%.

London, Munich, Manchester, and Lyon are expected to see the highest growth rates, exceeding 3% annually. While the report suggests continued robust rental growth, the rate of increase will be more moderate compared to the rapid rises of previous years.

“The leading markets will maintain solid growth, though at a more measured pace,” Kassner concluded. “The logistics sector remains strong, but we anticipate a phase of stabilisation rather than exponential expansion.”

The GARBE PYRAMID-MAP provides a comprehensive overview of rental trends and investment yields in Europe’s top logistics markets, offering valuable insights into the evolving dynamics of the sector.

Source: GARBE

Under the following link you can download the GARBE-PYRAMID-MAP:

https://nl.rueckerconsult.de/img/250120b_Garbe_Infografik_Logistik_25_1_Europa_2456162912025.jpg