IMF: Commercial Real Estate at a Crossroads

Empty office buildings. Reduced store hours. Unbelievably low hotel room rates. All are signs of the times. The containment measures put in place last year in response to the pandemic shuttered businesses and offices, and dealt a severe blow to the demand for commercial real estate—especially, in the retail, hotel, and office segments.

Beyond its immediate impact, the pandemic has also clouded the outlook for commercial real estate, given the advent of trends such as the decline in demand for traditional brick-and-mortar retail in favor of e-commerce, or for offices as work-from-home policies gain traction. Recent IMF analysis finds these trends could disrupt the market for commercial real estate and potentially threaten financial stability.

The financial stability connection:

The commercial real estate sector has the potential to affect broader financial stability: the sector is large; its price movements tend to reflect the broader macro-financial picture; and, it relies heavily on debt funding.

In many economies, commercial real estate loans constitute a significant part of banks’ lending portfolios. In some jurisdictions, nonbank financial intermediaries (e.g., insurance firms, pension funds, or investment funds) also play an important role despite the fact that banks remain the largest providers of debt funding to the commercial real estate sector globally. An adverse shock to the sector can put downward pressure on commercial real estate prices, adversely affecting the credit quality of borrowers and weighing on the balance sheets of lenders.

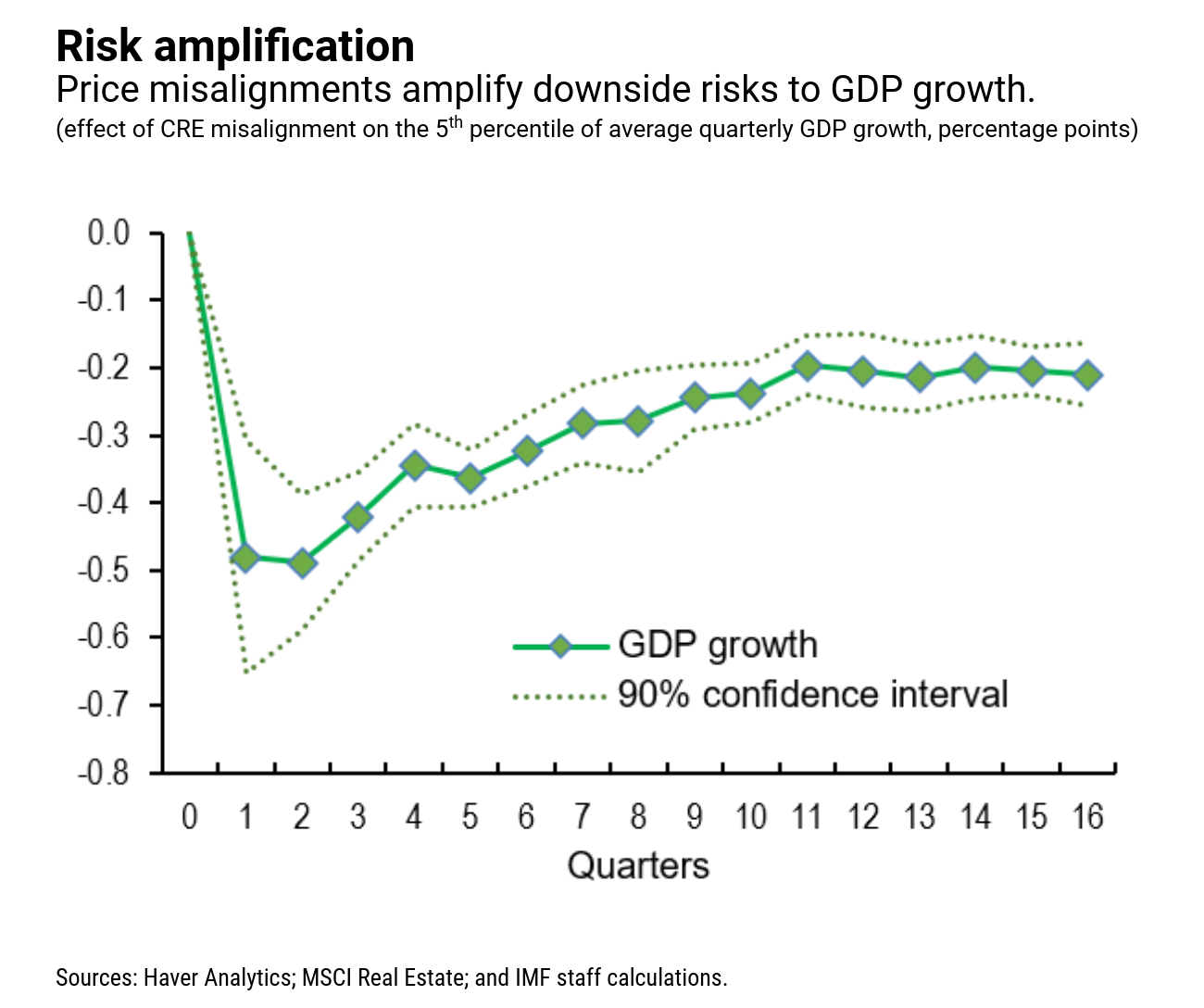

The risk of a fall in prices grows when we can observe large price misalignments—that is, when prices in the commercial real estate market deviate from those implied by economic fundamentals, or “fair values.” Our recent analysis shows that these price misalignments magnify downside risks to future GDP growth. For instance, a 50-basis-point drop in the capitalization rate from its historical trend—a commonly used measure of misalignment—could raise downside risks to GDP growth by 1.4 percentage points in the short term (cumulatively over 4 quarters) and 2.5 percentage points in the medium term (cumulatively over 12 quarters).

COVID-19’s heavy toll:

Looking at the impact of the pandemic, our analysis also shows that price misalignments have increased. Unlike previous episodes, however, this time around the misalignment does not stem from excessive leverage buildup, but rather from a sharp drop in both operating revenues and the overall demand for commercial real estate.

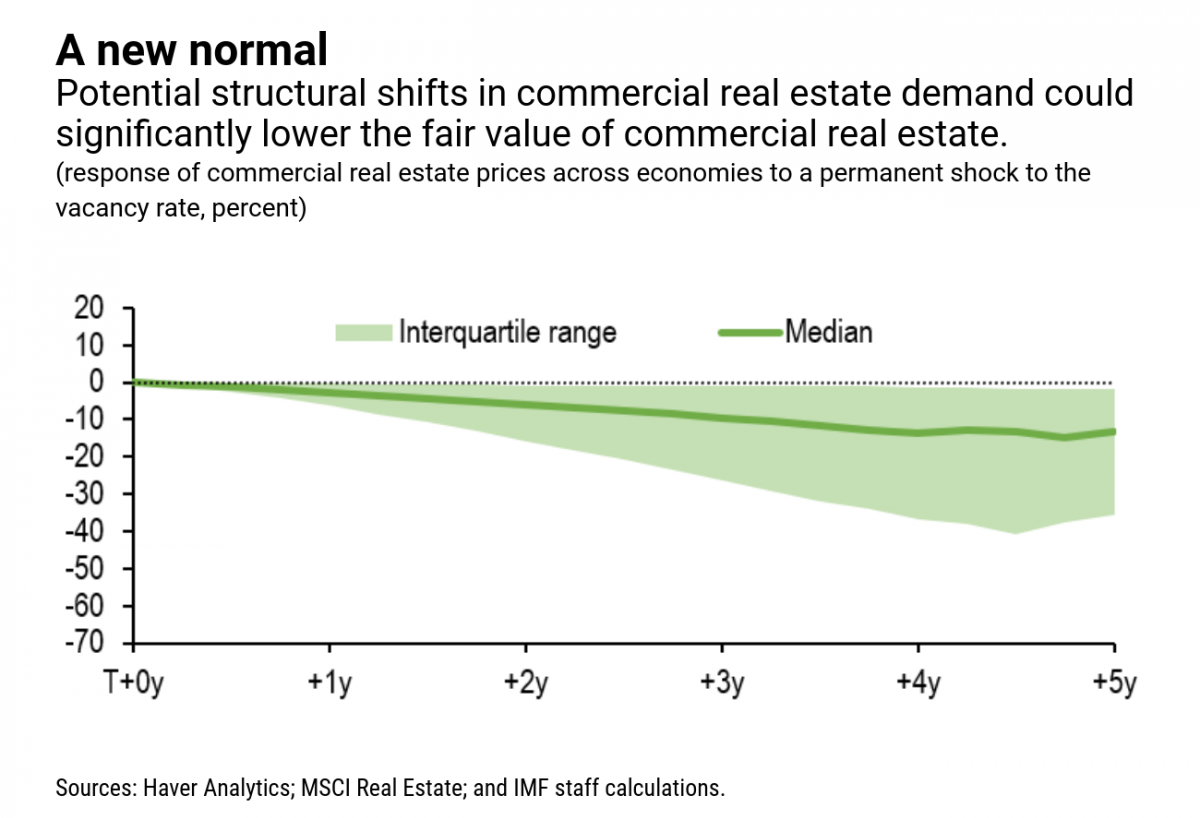

As the economy gains momentum, the misalignment is likely to diminish. Nevertheless, the potential structural changes in the commercial real estate market due to evolving preferences in our society will challenge the sector. For example, a permanent increase in commercial property vacancy rates of 5 percentage points (due to a change in consumer and corporate preferences) could lead to a drop in fair values by 15 percent after five years.

One must keep in mind, however, that there is huge uncertainty about the outlook for commercial real estate, making a definitive assessment of price misalignments extremely difficult.

Policymakers’ role in countering financial stability risks:

Low rates and easy money will help nonfinancial firms continue to be able to access credit, thereby helping the nascent recovery in the commercial real estate sector. However, if these easy financial conditions encourage too much risk-taking and contribute to the pricing misalignments, then policymakers could turn to their macroprudential policy toolkit.

Tools like limits on the loan-to-value or debt service coverage ratios could be used to address these vulnerabilities. Moreover, policymakers could look to broaden the reach of macroprudential policy to cover nonbank financial institutions, which are increasingly important players in commercial real estate funding markets. Finally, to ensure the banking sector stays strong, stress testing exercises could help inform decisions on whether adequate capital has been set aside to cover commercial real estate exposures.

Source: IMF