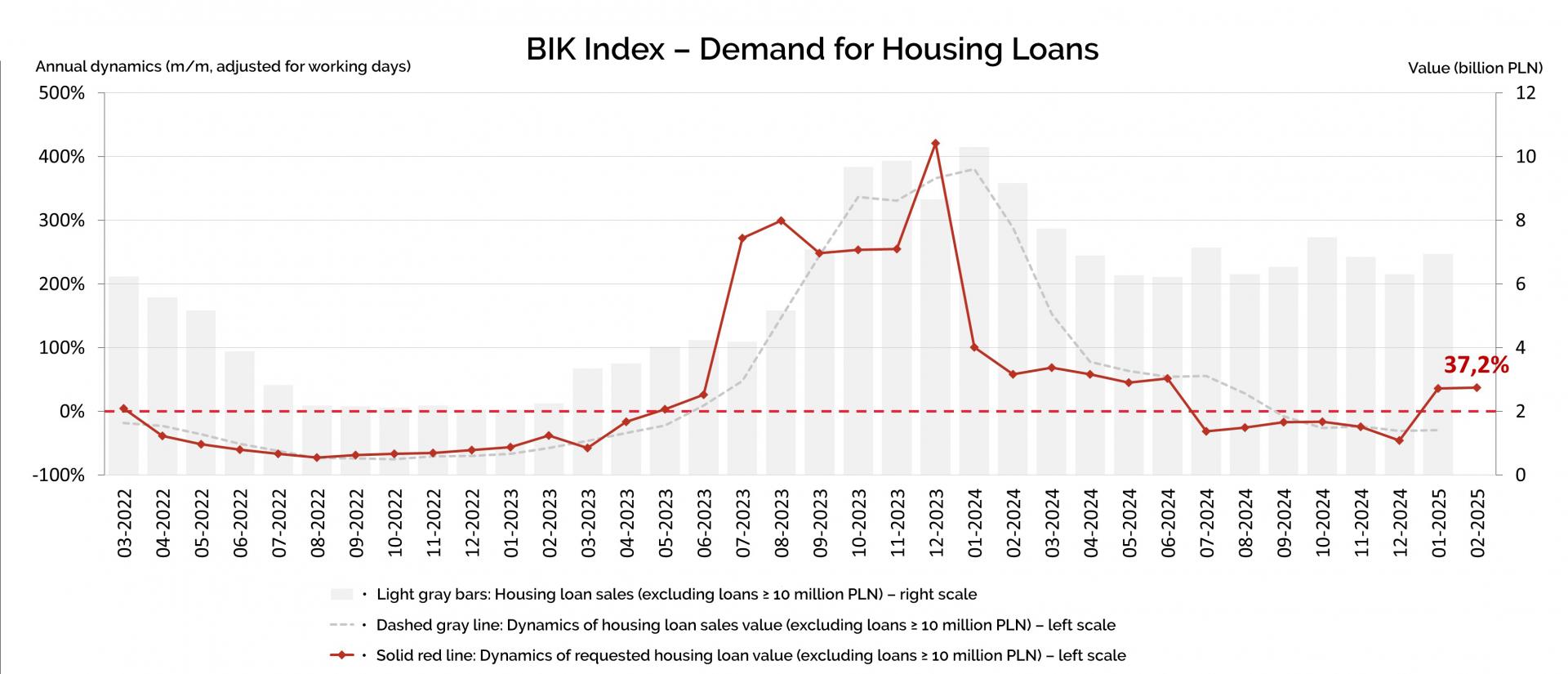

Poland's housing loan inquiries rise by 37.2% year-on-year in February 2025

The value of inquiries about housing loans in Poland increased by 37.2% year-on-year in February 2025, according to the BIK Index of Housing Loan Demand. This means that on a working day in February, banks and credit unions submitted requests for housing loans that were, on average, 37.2% higher in value compared to the same period in 2024.

The BIK Index for housing loans measures interest in mortgage financing by tracking the total value of loan applications submitted by individual customers. It is a key indicator used by analysts and financial institutions to assess trends in the mortgage market and forecast future credit activity.

In February 2025, a total of 33,110 people applied for a housing loan, compared to 26,640 in February 2024, marking an increase of 24.3%. Compared to January 2025, the number of applicants grew by 17%. The average requested loan amount reached PLN 449,100, up 5.1% from the previous year and 1.7% higher than in January 2025.

According to Dr. hab. Waldemar Rogowski, chief analyst at BIK Group, the 37.2% increase in the index should be analyzed in the context of last year’s figures. In early 2024, demand for housing loans had slowed following the conclusion of the “Safe Loan 2%” program in December 2023. He also noted that February saw a 17% rise in the number of applicants compared to January, a month that historically records lower mortgage demand. Additionally, as many loan applications involve multiple borrowers, the increase may reflect a decline in the number of single applicants.

Another factor influencing the index is the average loan amount, which reached a record high in February despite a 6% decline in transaction prices on the secondary market and relative price stability in the primary market. The data suggests that buyers are financing higher-value properties, often requiring multiple borrowers per loan. Looking ahead, Rogowski expects further increases in housing loan demand in the coming months of 2025.

Source: BIK