Romania: Residential deliveries have not kept up the pace with the high demand

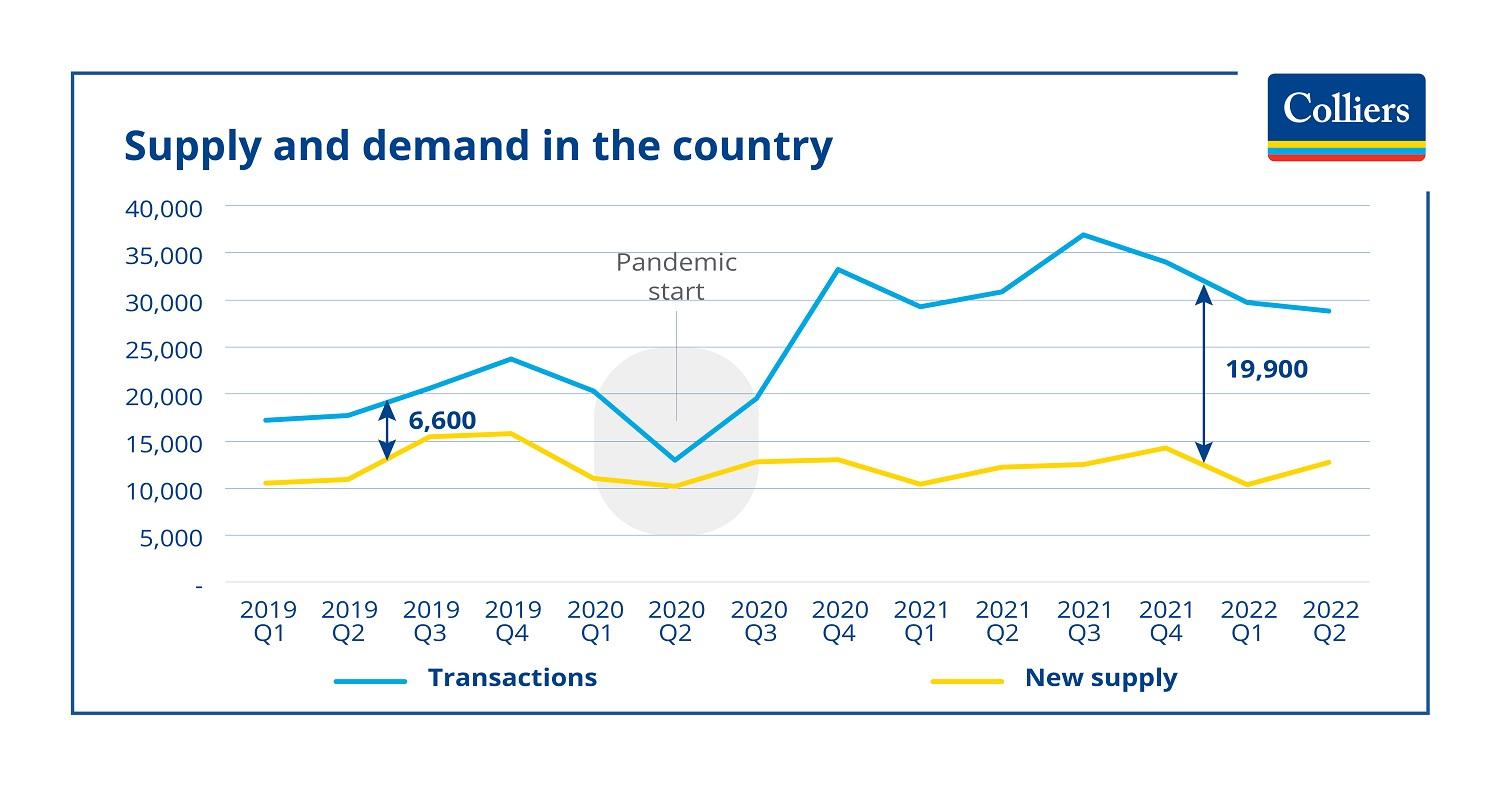

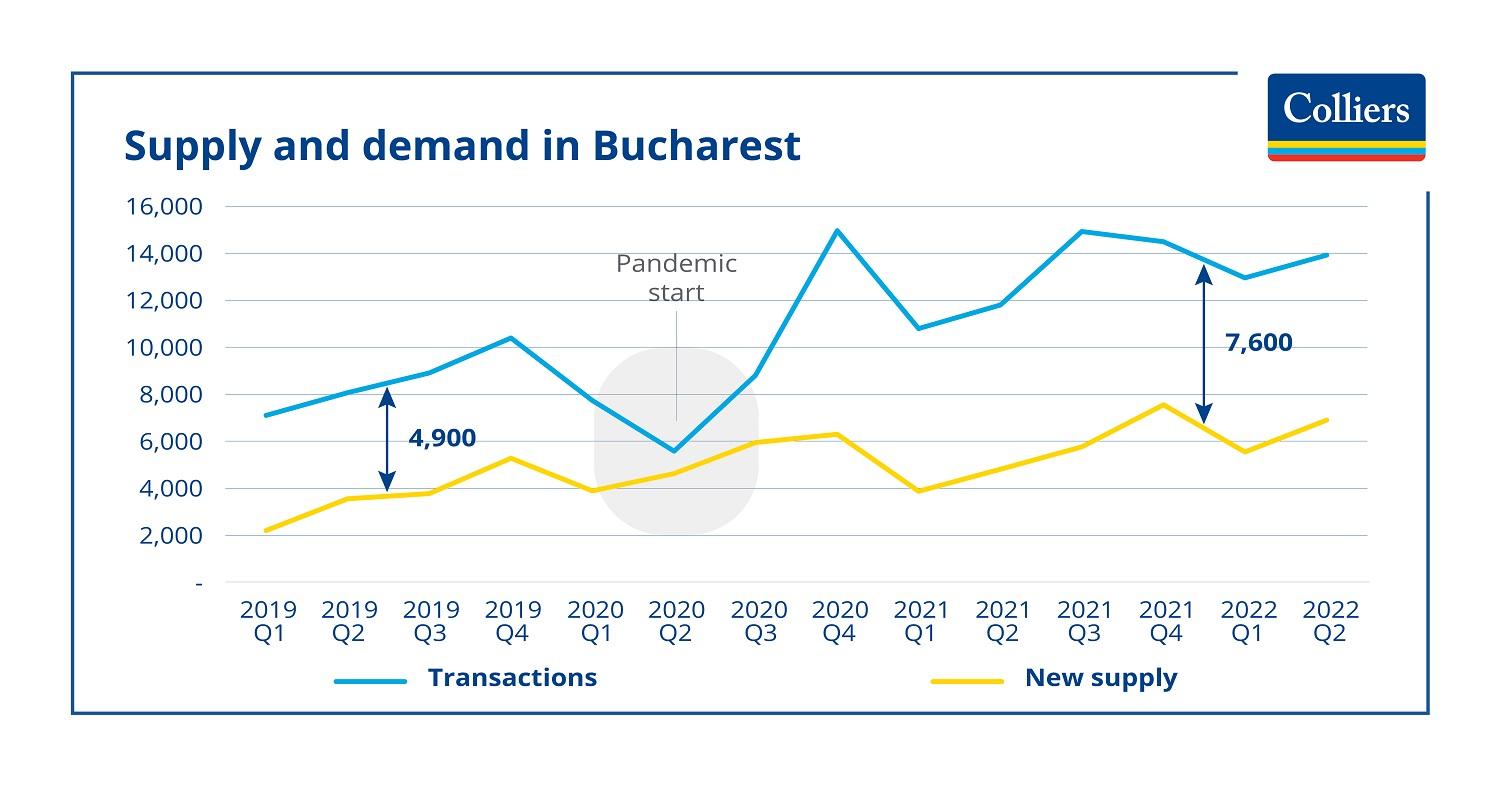

Romania's residential market is heading for a new record in deliveries this year as well, but the development pace has not kept up with the evolution of demand over the past two years. In addition, the price of new homes continues to rise as new projects incorporate increased prices for building materials, Colliers consultants point out. Over the past two years, housing has seen considerable price increases, with the main reason behind the trend being the strong growth in demand, amid a combination of factors such as the affordability of lending, rising wages and the increasing importance of living space.

The apartment transactions market set new records last year in terms of both sales and deliveries. In total, 71,405 homes were delivered nationwide in 2021, up 5% compared to the previous year. As the total surface authorized by developers in 2021 increased by more than 15% over 2020, to more than 12 million square meters, the residential sector is headed for new delivery highs this year. In the first quarter of the year, there was an 11% increase in the number of built housing units compared to the same period last year, and the volume of investments in new housing increased by 21% in the same period. The value of investments in the construction of new housing reached 4.6 billion lei in the first quarter, an increase of over 50%, an advance that emphasizes the significant increase in the prices of construction materials.

"Recent indications on the demand side suggest that there should be no problems with these areas being absorbed. The sales price is always the result of supply and demand, with demand in the residential market being positively driven by lending, both through low interest rates and the affordability of credit and supportive mortgage programmes. However, we are now witnessing a tightening of monetary policy, which could slow down the speed of credit growth. It remains to be seen how far interest rates will go in an attempt to tame inflation and what will be the impact of this trend in the number of mortgage loans granted," says Gabriel Blăniță, Associate Director Valuation & Advisory Services at Colliers Romania. Otherwise, as the Governor of the National Bank of Romania warned, there is a risk of a recession in the coming period, which would help reduce inflationary pressures, but would hinder the demand on the residential market as it would affect people's appetite to buy houses, Colliers' expert points out.