Catella Research: European logistics markets show stable yields and moderate rent growth

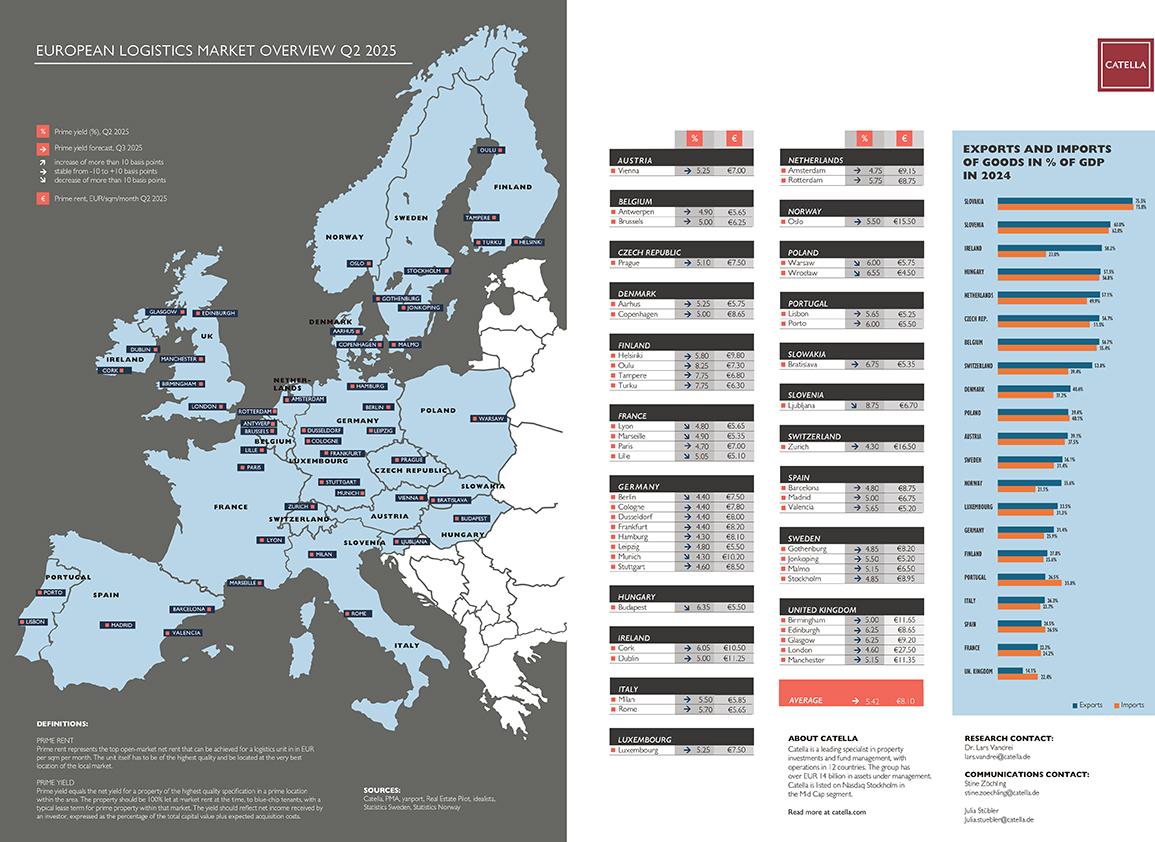

Catella has released its European Logistics Market Overview Q2 2025, analysing 50 logistics markets across 21 countries. The report highlights steady demand for warehouse space, shaped by supply chain shifts, alongside stabilising yields and elevated rental levels.

According to Catella, nearshoring and reshoring continue to drive demand as companies seek shorter supply chains and greater proximity to end markets amid trade tensions and global economic uncertainties. The trend is reinforcing the sector’s position as a core part of the European commercial real estate market.

“Prime rents for logistics properties had already been rising for years before accelerating with the outbreak of the war in Ukraine,” said Dr. Lars Vandrei, Head of Research at Catella Investment Management. “Although investment activity slowed after interest rate changes, logistics assets have since reached the same investment relevance as offices and remain central to the sector.”

Yields: steady with selective compression

The unweighted average prime yield across the surveyed markets was reported at 5.42%. While stability is expected overall, slight yield compression remains possible in selected locations, including Lyon, Marseille, Lille, Berlin, Munich, Warsaw, Wrocław, Budapest, and Ljubljana. Among the highest yields are Ljubljana at 8.75% and Oulu in Finland at 8.25%.

Rents: strong in metropolitan markets

Average prime rents across Europe stand at €8.10 per sqm per month. London leads with €27.50, followed by Zurich (€16.50) and Oslo (€15.50). At the lower end, Wrocław reports prime rents of €4.50. Catella notes that rents remain elevated in major metropolitan areas, reflecting strong occupier demand and limited supply.

Trade dependency: significant contrasts across Europe

The report also assessed the degree of trade dependency by country. Slovakia shows the highest export ratio at 75.5% of GDP, followed by Slovenia (63.0%) and Ireland (58.2%). Slovakia also tops import dependency at 75.8%. In contrast, the United Kingdom shows the lowest export share of GDP (14.1%) and more moderate import reliance (22.4%), despite recording the highest logistics rents and largest transaction volumes in Europe.

“Overall, we are seeing stabilisation in the markets,” said Marten Helms, Senior Fund Manager Europe at CIM. “Monitoring trade flows closely and identifying regions with potential remain key, particularly under current global uncertainties. We also see opportunities for counter-cyclical investment in sustainable logistics assets.”

Source: Catella

Download: Logistics Map on the below link:

https://nl.rueckerconsult.de/img/Logistik-Map_4723182392025.pdf